1. RFC summary

The Open Stablecoin Index $OPEN (www.openstablecoinindex.com) is not a traditional index product. There are no central middlemen (company, CEO, etc.). It is a decentralized experiment in open and verifiable smart contract systems where community coordination and self-improving design may evolve, though no outcome is guaranteed.

RFC Objectives:

- Introduce the OPEN Universe whitelist to establish a transparent community registry separating project qualification from index composition.

- Replace subjective governance with OPEN Rules that use quantitative, credibly neutral metrics for liquidity, efficiency, and growth.

- Transition from static index equal-weighting to adaptive parameters that follow OPEN Rules

2. Problem:

OPEN is currently an equal-weighted onchain index of 10 stablecoin-network governance tokens (e.g. AAVE, CRV, RSR, FXN, etc.). Currently, inclusion in the OPEN index is subjectively decided by vlSQUILL holder votes, introducing fairness and quality concerns. This also adds administrative friction and reduces appeal for CEX listings and strategic partners that prioritize decentralized, credibly neutral assets. See ex1 and ex2 for step-by-step of the historical friction and underlying concerns.

While OPEN’s current equal-weighting index methodology is straightforward, it overlooks meaningful differences in value, growth, and liquidity among constituents. As OPEN’s TVL grows, this blind spot can obscure emerging opportunities and create mint or redemption inefficiencies when basket weights diverge from market liquidity.

3. Proposed solution

The idea is to make the index more rules based and predictable, whilst also engaging governance more regularly. It separates the subjective / procedural question of whether the token fits the bill from the actual index composition. It introduces a new concept of the OPEN Universe whitelist which is more expansive than the index. It also forces focus on quantitative criteria, the OPEN Rules, for inclusion. This also aims to protect against governance attacks and make the index less risky as collateral.

3a. OPEN Universe: proposed whitelisting process

An RFC + Snapshot vote can be raised anytime to add/remove a project from the OPEN Universe. The Universe is essentially a whitelist of approved tokens that vlSQUILL governance believes have the right qualities.

- 1d [Anyone] submit the Universe whitelist application & post the 18-field receipt (auto-emailed back to you) to the public RFC

- ~1d [OPEN] adds project to Universe dashboard + RFC

- 5d [vlSQUILL] discusses, debates, challenges RFC in public

- ~1d [OPEN] initiates vlSQUILL Snapshot vote

- 3d [vlSQUILL] Snapshot vote Y or N

To educate the community about $OPEN and its constituent protocols, a consistent, easy to use and implement KnowledgeBase is needed. The Universe whitelisting application hits three goals at once: whitelist applications, building the KnowledgeBase, and standardizing RFCs.

The OPEN community runs on part-time volunteer energy, not VC capital. Tools will begin as a lean MVP and improve through iteration and automation.

3b. OPEN Rules: proposed methodology

Currently, $OPEN is equal-weighted. We propose a new, quantitative weighting model adjustable by vlSQUILL holders. Parameters can be added, removed, or rebalanced through governance to fine-tune exposure across liquidity, growth, and value dimensions.

At OPEN rebalance time, the index is updated with Universe tokens according to previously agreed quantitative parameters below. and a vlSQUILL onchain vote ratifies this.

Parameters:

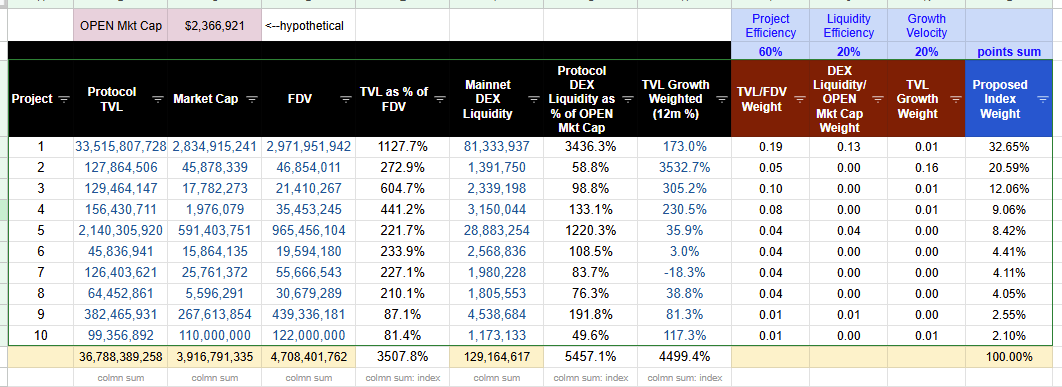

The initial proposed methodology parameters are:

- Multi factor index weighting:

- 20% Liquidity efficiency, metric: constituent token DEX Liquidity as % of OPEN’s TVL

- 60% Project efficiency, metric: TVL as % of FDV

- 20% Growth velocity, metric: Y-o-Y TVL growth

- Target index constituents: up to 10

- Rebalance frequency: quarterly

- Component weight Max/Min band: If a component exceeds 40% or drops below 1% between rebalances, governance may propose weight changes, additions, or removals to maintain index health

Liquidity Efficiency

Measured as constituent DEX liquidity relative to OPEN index TVL size, this metric ensures smooth rebalancing operations and minimises execution costs. Analysis shows that slippage increases non-linearly with trade size across different AMM designs. Concentrated liquidity (Uniswap v3) substantially improves on constant product AMMs by focusing liquidity within specific price ranges.

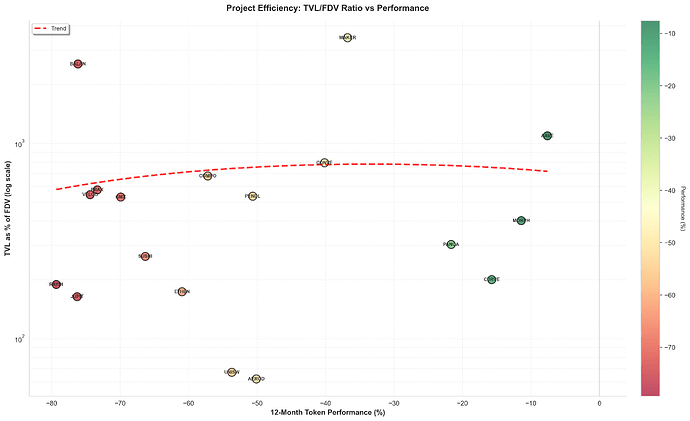

Project Efficiency

The TVL/FDV ratio serves as a primary metric for project quality and sustainability, warranting the highest 60% allocation. Analysis demonstrates a minor positive correlation between high TVL/FDV ratios and 12-month token performance.

Projects with low TVL high FDV is a sign of actual or perceived project inefficiency and low value. It may be actually inefficient and lower value, if circulating supply is high. It may be perceived inefficient and lower value if circulating supply is low, which creates a first impression metrics-legibility issue among other concerns.

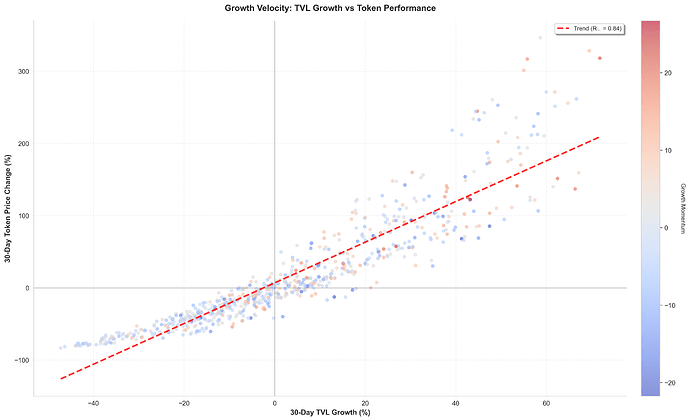

Growth Velocity

Measured by year-on-year TVL growth, this captures momentum and expanding adoption of stablecoin protocols. Analysis reveals significant correlation between 30-day TVL growth and token price performance, with growth acceleration providing additional predictive power. Balancing growth velocity against the conservative project efficiency metric allows the index to capture upside from emerging leaders whilst maintaining a foundation in established protocols with proven fundamentals.

Table 1: Conceptual index basket illustrated:

Link to inspect spreadsheet formulas.

Anyone can make a proposal to modify OPEN indexing weights or add/remove variables.

4. Targeted success metrics after 12 months

If the proposal is accepted, OPEN aspires to the following.

- 6+ OPEN Universe whitelisting proposals submitted per year

- 2+ data-back-tested OPEN Rules proposals per year improving methodology, parameters, or weighting.

- 20%+ vlSQUILL participation rate per proposal

- 15%+ increase in unique voter participation per year

- OPEN index Y-o-Y growth outperforms ETH and COIN50

- No successful governance attacks

5. Closing: before and after comparison

Table 2: Summary of the proposed changes.

We welcome your questions and feedback.

Any proposed changes in the comments are invited to include actionable supporting data or analysis from the contributor. Please include any concerning attack vectors for this approach in your RFC comments. Counter proposals from the community are also invited.

Thank you for considering.