I appreciate the healthy discussion on this forum post and the conversation we had on the latest GovOps concerning eUSD, found here. Both have been extremely helpful in formulating my own opinions on the path forward for eUSD.

Firstly, i’d like to share some of the eUSD data i’ve worked on since the creation of this forum post. Given that these are some of the most pertinent data points for eUSD right now I wanted to make them as easily digestible as possible, reducing friction for other governors who don’t have the time to look into the data themselves.

Figure 1 - Historical Revenue Share and Over-Collateralisation

This chart presents the varying revenue distributions at each snapshot since the start of the revenue share programme and has the over-collateralisation, OC super-imposed. As we can see fintech holdings and rev share has grown while eUSD TVL has remained relatively flat, which strongly suggests fintechs are swapping into eUSD rather than minting, a trend I think we will see reverse if fintechs continue along the same growth trajectory we have seen up until now. Naturally, over the same duration we have seen the OC drop from 111% to 71% as revenue share is taken away from Staked RSR holders and given to the fintechs, a trend I think will continue as long as we see sustained fintech growth.

How the frequency of rebalances affects revenue distributions

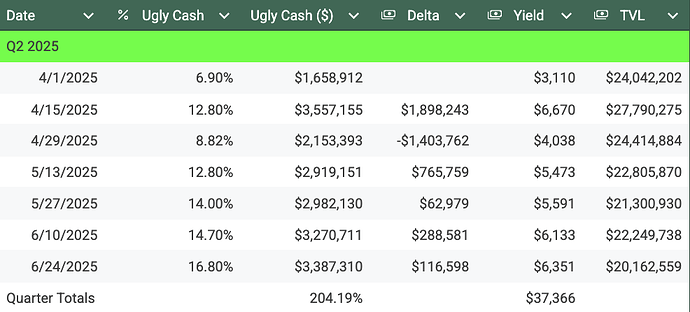

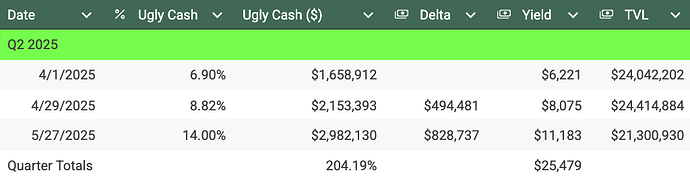

This work came off the back of @0xJMG comments about RFC frequency and governor fatigue. The data here is rough and ready using what was available from @Raphael_Anode and @0xJMG tables, I didn’t have time to snoop on the chain myself and pin these exactly, E.G in Figure 2 the final data point - 6/24/25 spans two quarters falsely inflating the Figure 2 totals. I think it’s accurate enough for our needs showing the amount of revenue that would be distributed to Ugly Cash, UC at various RFC frequencies.

TLDR - Given UC’s sustained growth every quarter at least bi-weekly rebalances are required to match their holdings and most optimally supports their Earn programme.

Figure 2 - Bi-weekly Rebalances

Figure 3 - Monthly Rebalances

Figure 4 - Quarterly Rebalances

Comments on The Data

All of the data can be found here and if anyone finds holes in it I’m more than open to discuss it further. I also strongly encourage @Sawyer to take over the torch here and continue to collect future data and display these in upcoming quarterly reports to demonstrate to governors why this programme should continue and why we must persist with bi-weekly rebalances for the time being. If you chose to do so please check the eUSD TVL data as @0xJMG said on the latest GovOps that he collected data from Coingecko which may be inaccurate when compared to the Reserve Register.

Path Forward for eUSD

Personally, I agree with @Sawyer that the only avenue for growth available to eUSD is via fintechs and as such I’m a strong supporter of the revenue share programme but I don’t think that the programme and eUSD growth shouldn’t come at the detriment to eUSD stakers as it does in it’s current format.

There are three optimisations that I would like to see occur; increased transparency from fintechs, decreased RFC frequency and a clear understanding of what is an acceptable level of over-collateralisation for the fintechs holding eUSD and a plan of what will happen once we reach it.

Transparency

I think the best argument for increased transparency is the discussion @Raphael_Anode and @Sawyer has in the latest GovOps call so won’t outline it again here but I’m heavily in favour. Just like @josh said in his comments that it’s becoming a non-negotiable that stablecoin holders get treasury APY, it’s also a non-negotiable that incentive programmes require documentation especially since as stakers we’re currently providing OC at no cost on all fintech eUSD holdings.

I agree with Raph that this is table stakes across incentive programmes and I encourage UC to instead of coming to the forums and asking us to check their socials, check the chain for data to come to the forums instead, I suggest updating us on publicly available data once a quarter and feel that a addendum under Sawyer’s quarterly report will satisfy most governors, this satisfies documentation requirements and is also a gesture of good faith, showing us you that you value and respect our commitment to supporting your continued growth and for proving the over-collateralisation which you have said you use in your marketing materials.

I respect your time and commitment to keep key strategic insights secret which is why I suggest completing this once a quarter in line with the quarterly reports and will accept data which is already public knowledge or data that can already be found by your competitors easily.

RFC Frequency

I also think this was covered in detail in our last call and encourage anyone whose got this far down this post to listening to that in full. I hope the data above further supports the ongoing need for bi-weekly ratification votes. However, I’m also deeply concerned about governor fatigue and think we as eUSD governors should work towards governance flow optimisations to reduce the amount of votes required. I look towards people like @Raphael_Anode, @pmckelvy and @mattimost for their input into this and think Tom’s own comments from the original revenue share proposal, found below, and Raph’s around Optimistic Governance are great stepping off points for this discussion.

Over-collateralisation of eUSD

Finally, I’m also concerned about the inverse relationship of fintech revenue share and the levels of OC eUSD enjoys. As expected with growing fintech rev share we’re seeing a decrease in eUSD’s OC ratio. Given this inverse relationship and the expectation that fintech growth will continue I expect eUSD’s OC to continue to drop. While I find that acceptable at current levels given the large degree of OC eUSD currently enjoys, ~80% i’m concerned that with sustained growth and unchecked rebalances the levels of OC will eventually drop below permissible levels.

It looks like this is already being considered by fintechs given @josh remarks.

However, I would rather be proactive rather than reactive with these discussions, avoiding a future where we are making quite decisions in a pinch that leading to bigger issues for eUSD and the protocol further down the road.

Next Steps

As an eUSD governor and delegate I don’t think any of these requests are out of pocket and all would go a long way in furthering the symbiotic relationship eUSD has cultivated with the revenue share programme between fintech and governor.

Given some of these changes require more discussion, governance changes or engineering work I don’t expect them to happen overnight but think they should be worked on by all stakeholders over the coming months.

I feel the end of the quarter is a suitable timeframe for the fintechs to address the issues around transparency and lines up well with Sawyer’s Q3 report and until the end of Q4 for the issues raised around RFC frequency given the strongly likelihood of governance and engineering.

If any of these items aren’t addressed in a timely manner I’d be open to submitting or supporting a RFC to end the revenue share programme, although I hope it doesn’t come to this!