ETHplus Quarterly Report Q2 2025

This report aims to provide a comprehensive update of all ETHplus related activities over the last quarter, including both on-chain and off-chain data. The purpose of this report is to inform and educate the wider Reserve community on the activities of ETHplus over the last quarter while becoming a reference library for all governance, social media and on-chain data.

We are up against the limits of the forum software with these quarterly reports and it can be difficult to view and parse the data below. If you’d prefer you can find an identical version of the Q2 report in a Google Document here.

ETHplus Core Metrics and Relative Change

| Metric | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| Price ($) | $1,700.00 | $2,560.00 | 50.59% |

| Price Relative to ETH | 1.04 | 1.05 | 0.96% |

| ETHplus Yield | 2.76% | 2.60% | -5.80% |

| Market Cap ($) | $103,000,000 | $230,000,000 | 123.30% |

| ETH Supply | 64,893 | 94,270 | 45.87% |

| Staked RSR ($) | $5,100,000 | $5,630,000 | 10.39% |

| Staked RSR ($RSR) | 610,000,000.00 | 842,000,000.00 | 38.03% |

| Total TVL | $108,100,000 | $235,630,000 | 117.97% |

| RSR Backing | 5.00% | 3.00% | -40.00% |

| RSR Staking Yield | 3.10% | 5.66% | 82.58% |

| Diversification Ratio | 65.54% | 65.54% | 0.00% |

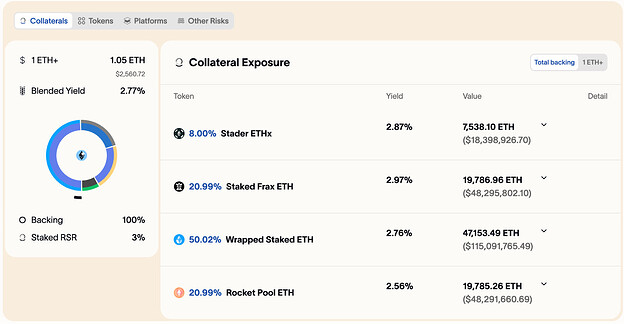

Current ETHplus Collateral Basket

| Collateral Asset | Allocation | Yield | Basket Yield |

|---|---|---|---|

| wstETH | 50.00% | 2.76% | 1.38% |

| rETH | 21.00% | 2.56% | 0.54% |

| sfrxETH | 21.00% | 2.96% | 0.62% |

| ETHx | 8.00% | 2.87% | 0.23% |

| Total Yield Profile | 2.77% | ||

| Diversification Ratio | 0.66 |

Token Holder and Transfer Metrics

| Metric | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| Holders | 217.00 | 244.00 | 12.44% |

| Transfers (90d) | 49,047.00 | 65,025.00 | 32.58% |

| Total Transfers | 25,555.00 | 25,540.00 | -0.06% |

DeFi Integrations

| Supply across DeFi Markets | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| DeFi ($) | $40,200,000 | $117,440,000.00 | 192.14% |

| DeFi (ETH) | 23,616 | 45,875 | 94.25% |

| Morpho ($) | $33,800,000 | $103,000,000 | 204.73% |

| Morpho (ETH) | 19,904 | 40,234 | 102.14% |

| Curve ($) | $4,400,000 | $9,607,680 | 118.36% |

| Curve (ETH) | 2,576 | 3,753 | 45.69% |

| Uniswap ($) | $542,300 | $929,280 | 71.36% |

| Uniswap (ETH) | 319 | 363 | 13.79% |

| Term Finance ($) | $1,400,000 | $3,904,000 | 178.86% |

| Term Finance (ETH) | 817 | 1,525 | 86.66% |

Morpho Markets

| Morpho | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| ETHplus / WETH | |||

| Total Supply | $33,600,000 | $102,000,000 | 203.57% |

| Total Borrow | $30,000,000 | $91,000,000 | 203.33% |

| Available | $3,400,000 | $11,000,000 | 223.53% |

| Liquidations | $0 | $0 | |

| Vaults | |||

| MEV Capital WETH | $21,400,000 | $60,700,000 | 183.64% |

| Gauntlet WETH Core | $7,300,000 | $11,000,000 | 50.68% |

| Re7 WETH | $25,000,000 | $10,000,000 | -60.00% |

| Yearn OG WETH | $0 | $9,600,000 | New Allocation |

| Index Coop hyETH | $1,700,000 | $3,000,000 | 76.47% |

| TAC ETH | $0 | $866,000 | New Allocation |

| AlphaRing | $0 | $500,000 | New Allocation |

| — | — | — | — |

| ETHplus / eUSD | |||

| Total Supply | $236,000 | $1,000,000 | 323.73% |

| Total Borrow | $147,000 | $800,000 | 444.22% |

| Available | $85,000 | $200,000 | 135.29% |

| Liquidations | $0 | $0 | |

| Vaults | |||

| Gauntlet eUSD Core | $237,000 | $885,000 | 373.42% |

Curve LP Pairs

| Curve | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| ETHplus / ETH | |||

| Total TVL (ETH) | 3,680 | 5,819 | 58.13% |

| ETHplus (ETH) | 1,390 | 2,181 | 56.91% |

| ETH | 2,288 | 3,638 | 59.00% |

| — | — | — | — |

| ETHplus / eUSD / RSR Tri-Pool | |||

| Total TVL (ETH) | 2,250 | 1,610 | -28.44% |

| ETHplus (ETH) | 750 | 538 | -28.27% |

| eUSD ($) | $1,290,000 | $1,400,000 | 8.53% |

| RSR (RSR) | 155,000,000 | 207,000,000 | 33.55% |

| — | — | — | — |

| ETHplus / dgnETH | |||

| Total TVL (ETH) | 848 | 1,797 | 111.91% |

| ETHplus (ETH) | 436 | 1,034 | 137.16% |

| dgnETH (ETH) | 448 | 763 | 70.31% |

Uniswap LP Pairs

| Uniswap | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| ETHplus / ETH | |||

| Total TVL (ETH) | 651 | 643 | -1.23% |

| ETHplus (ETH) | 319 | 363 | 13.79% |

| ETH | 332 | 280 | -15.66% |

Term Finance Markets

| Term Finance | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| Shorewoods ETH Vault | |||

| Total Supply (ETH) | 1492 | 2330 | 56.17% |

| Total ETH+ Allocation (ETH) | 656 | 1165 | 77.59% |

| Percent Allocated to ETHplus | 44% | 50% | |

| — | — | — | — |

| August Digital ETH | |||

| Total Supply (ETH) | 92 | 180 | 95.65% |

| Total ETH+ Allocation (ETH) | 46 | 180 | 291.30% |

| Percent Allocated to ETHplus | 50% | 100% | |

| — | — | — | — |

| UltraYield ETH Vault | |||

| Total Supply (ETH) | 93 | 180 | 93.55% |

| Total ETH+ Allocation (ETH) | 46 | 180 | 291.30% |

| Percent Allocated to ETHplus | 50% | 100% | |

| — | — | — | — |

| Re7 ETH Vault | |||

| Total Supply (ETH) | 93 | Decommissioned | |

| Total ETH+ Allocation (ETH) | 69 | Decommissioned | |

| Percent Allocated to ETHplus | 74% | Decommissioned |

Governance

Proposal 1 - Collateral basket change proposal to address liquidity bottlenecks

Total unique commenters - 6

Off-chain Poll - 4 votes (2 for / 2 against)

Total RSR voted - 184m (69m for / 115m against)

Social Media

This section looks at the data surrounding the ETHplus X account only

| Social Media | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| Posts | 40 | 22 | -45.00% |

| Impressions | 7,000 | 10,350 | 47.86% |

| Profile Clicks | 51 | 41 | -19.61% |

| Followers | 1,240 | 1,313 | 5.89% |

Most Viral Tweet

Conclusion

Quarter 2 has been another phenomenal quarter for ETHplus. While on the surface growth could be dismissed as being attributed to wider market conditions and recent Ethereum headwind abating, the numbers tell a different story. We have now seen exponential quarter on quarter growth for ETHplus supply and an explosion in the market cap as ETH price has appreciate along with it. Last quarter we concluded that this is likely due to the increasing compostability of ETHplus across DeFi markets, this is even more so this quarter with a 200% increase in supply across Morpho markets, growing an already sizeable market from $33m to $103 and similar growth across Term Finance although a smaller market, 175% from $1.4m to $3.9m and Curve with 118% from $4.4m to 9.6m. Ethereum has only appreciated in price 34% over the quarter meaning we have also seen considerable supply increases to these markets.

| ETHplus Growth | Close of Q4 | Delta (Q4/Q3) | Close of Q1 | Delta (Q4/Q1) | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|---|---|---|

| Market Cap ($) | $157,000,000 | 4.00% | $103,000,000 | -34.39% | $230,000,000 | 123.30% |

| ETH Supply | 50972 | 23.00% | 64,893.00 | 27.31% | 94,270.00 | 45.27% |

| ETH Price Action | $3,350 | 29% | $1,824 | -45.55% | $2,451 | 34.38% |

We have seen one proposal hit the forums this quarter, which was a liquidity analysis with the aim of optimising the collateral basket’s minting and redemption curves based on the available on-chain liquidity. The RFC led to an IP put forward by Pete, Origin BD, this proposal was not to vote on the basket proposed in the RFC since governors had concerns about about holding 30% of OETH TVL and the complexity of the LST, instead opting for a slow introduction in an attempt to alleviate some of the other governors concerns. Unfortunately this IP was unsuccessful. Outside of the forums ETHplus is still enjoying growth in the number of RSR staked on the RToken this quarter with a 38% showing stakeholders are keen to have a vested interest in the future of the token.

Despite the significant growth in core ETHplus metrics we have seen a decline in social media metrics across the board, these can likely be attributed to a slow posting cadence and lack of cross-posting from similarly aligned protocols and independent twitter users. If we are going to keep the monumental growth we have seen across the quarters our social media presence must improve.

In summary this has been another great quarter for ETHplus with impressive gains in ETH supply coupled with ETH price appreciation being well reflected in the total market cap. Given we have seen most of our growth from DeFi protocols it is time to lean into those in this next quarter and improve our social media reach to keep pushing towards a 10 figure TVL.

Once again I’d like to thank the community and the wider Reserve team for their continued support of ETHplus this quarter. Please consider this as an open invitation to anyone thinking about contributing to or have any feedback about the ETHplus strategy to reach out by either under this post or privately.

TG: @hamdefi

Discord: Ham6869