Welcome to the Q2 2025 quarterly report for Web 3 Dollar (USD3), designed to provide a comprehensive snapshot of the project’s performance and ecosystem developments. This report dives into key metrics, including governance activities across the forums and onchain, TVL(Total Value Locked) trends, critical DeFi metrics, and evolving social media engagement. By presenting these insights, our goal is to keep the USD3 community well-informed, foster transparency, and encourage active participation in the ongoing growth and success of USD3.

Current USD3 Collateral Basket:

| Collateral Asset | Allocation | Yield |

|---|---|---|

| sDAI (DAI Savings Rate) | 25% | 2.00% |

| Morpho Steakhouse USDC Vault | 25% | 4.08% |

| Comp v3 USDC | 25% | 4.30% |

| Aave v3 USDC | 25% | 4.00% |

| USD3 APY | 3.20% |

Summary: This section highlights the current collateral basket and the yield profile of USD3. The yields across DeFi appear to have bottomed out, this is reflected in the USD3 yield change quarter over quarter. USD3 yields went from 3.6%(Q1) to 3.2%(Q2). This is not as drastic of a change from Q4 2024 to Q1 2025 where USD3 was seeing yields over 9% APY in Q4 of 2024. One of the other changes we will likely see to the collateral basket is the removal of sDAI and the addition of sUSDS. Currently sUSDS is yielding about 4.5% APY, and this would improve the yield profile of USD3.

USD3 Market Cap, TVL, and Other Core Metrics:

| Metric | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| Price ($) | $1.046 | $1.051 | +0.47% |

| Market Cap ($) | $35,160,281 | $49,961,851 | +42% |

| USD3 Yield | 3.63% | 3.25% | -10% |

| USD3 Supply | 33,614,036 | 47,402,136 | +41% |

| Staked RSR ($) | $3,988,733 | $4,633,135 | +16% |

| Staked RSR (RSR) | 643,344,118 | 681,343,396 | +5.9% |

| Total TVL | $39,149,014 | $54,594,986 | +39% |

| Overcollateralization (%) | 11% | 9.2% | -16% |

| RSR Staking Yield | 4.8% | 4.8% | 0% |

Summary: This section looks at the total market cap of USD3 and the TVL accounted for in the Reserve Yield Protocol. Quarter over quarter we have seen positive growth across all metrics except one. The one metric that had a negative delta was the overcollateralization, this is likely attributed to minimal growth of new RSR stakers relative to the steep growth in the Market Cap of USD3. The negative delta in this metric is not cause for concern as 9.2% overcollateralization is sufficient.

DeFi and Onchain Metrics

Transactions and Holders on Mainnet

| Metric | Q1 | Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| Holders | NA | 89 | NA |

| Total Transactions | 1,015 | 939 | -7.48% |

Integrations

Morpho

| Morpho Gauntlet eUSD Vault | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| USD3 Supplied | $804,300 | $3,500,000 | +335% |

| Supply Cap | NA | $3,500,000 | NA |

| Utilization | NA | 91.98% | NA |

Curve

| USD3/scrvUSD Pool | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| USD3 Supplied | $389,000 | $926,718 | +138% |

| scrvUSD Supplied | $369,000 | $878,297 | +138% |

| Total Pool TVL | $793,000 | $1,899,565 | +139% |

| USD3/sUSDe Pool | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| USD3 Supplied | $306,000 | $419,071 | +36% |

| sUSDe Supplied | $610,000 | $519,633 | +14% |

| Total Pool TVL | $1,030,000 | $1,053,570 | +2.2% |

| USD3/sDAI Pool | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| USD3 Supplied | $659,000 | $520,826 | -20% |

| sDAI Supplied | $537,000 | $360,932 | -32% |

| Total Pool TVL | $1,310,000 | $967,674 | -26% |

| USD3/sUSDS Pool | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| USD3 Supplied | NA | $445,620 | New Pool |

| sUSDS Supplied | NA | $323,411 | New Pool |

| Total Pool TVL | NA | $811,358 | New Pool |

Summary: The most impressive metric quarter over quarter is the increase in utilization and supply in the Morpho gauntlet eUSD Vault. Currently the borrow APY(as of writing this report) is 7%, but the USD3 APY is 3%. It’s unlikely that there is a profitable spread to loop this market, instead there appears to be demand for eUSD with profitable yield opportunities elsewhere throughout DeFi. It can be as simple as borrowing eUSD to supply eUSD to this same vault to take advantage of the added incentives of up to 10% APY.

The liquidity across the Curve pools has seen growth quarter over quarter with the exception of one pool, USD3/sDAI. This is likely due to the recent lowering of the DAI Savings Rate which as of writing this is at 2% APY. With the recent addition of the USD3/sUSDS pool, I wouldn’t be surprised to see some of the liquidity from the USD3/sDAI pool migrate over to the USD3/sUSDS pool. USD3 has seen very impressive utilization and growth across DeFi and is primed to continue to see growth going into Q3.

Governance:

Proposal 1: USD3 Unregister Unused Asset: USDP

Views: 34

Off-chain Poll - 4 votes (4 for / 0 against)

Onchain Poll:

Quorum: 64M RSR

Voter Turnout - 145M (145M for / 0 against)

Unique Voters: 4

Outcome: Proposal Passed

Proposal 2: Fusion for USD3 assets yield optimization

RFC

Post Views: 151

Off-chain Poll - 5 votes (5 for / 0 against)

Awaiting IP

Proposal 3: USD3 Collateral Basket Change Proposal #4

RFC

Post Views: 35

Off-chain Poll - 4 votes (4 for / 0 against)

Awaiting IP

Summary: The most interesting proposal to hit the forums is the Fusion Vault for USD3 assets yield optimization. If you haven’t read the proposal, I highly recommend reading it. In short, the idea is to upgrade USD3 collateral plugin to an ERC4626 standard. The reason for the upgrade would be to allow the underlying collateral to be dynamically managed by a set of smart contracts that optimize for yield. This is a big change for USD3 and Yield DTF’s as a whole, if this proposal moves onchain and is successful in improving the yield profile, we could see rapid growth to USD3’s Market Cap and presence throughout DeFi.

Social Media

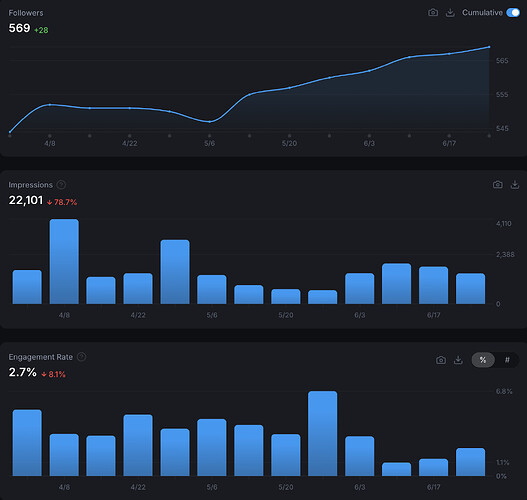

| Social Media | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| Posts | 71 | 70 | +1.4% |

| Impressions | 108,000 | 22,101 | -79% |

| Engagement Rate | 3% | 2.7% | -8.1% |

| Followers | 541 | 569 | 5.89% |

Summary: The impressions metric is the most notable item that dropped significantly. This can be explained by last quarter a paid post hit over 50k impressions that resulted in almost half of the entire impressions for that quarter. This quarter there weren’t any paid posts, I think paid posts have their use cases but at the current state of the USD3 brand, I am not sure driving the impressions number without having a clear plan is the right course of action. Even though there was a steep drop in impressions, the most important metric is the engagement rate. Even though there was a slight decline, if we take the ratio of engagement rate to impressions, the content for Q2 appeared to be more effective and engaging to our audience. The regular post cadence stayed the same with about the same number of posts. Highlighting yield opportunities is the most effective content for the USD3 account.

Conclusion:

That concludes the Q2 2025 report. Comment below any questions and comments you might have and make sure to stay up to date on all things USD3 by following the X account here:

Disclaimer: This is everything that happened, a celebration of the community and an invitation to participate in the ongoing success of USD3. Continue to participate in the gov ops call, continue to participate on the forums and in onchain votes.

USD3: created on the Reserve Yield Protocol ![]()