Summary

This proposal recommends changing the ETHplus mandate to include LRTs and adding weETH, the liquid restaking token from Ether.fi, to the ETHplus collateral basket. weETH currently commands ~87% of the total liquid restaking (LRT) market, giving weETH deep liquidity, strong adoption, and reduced integration risk relative to smaller LRTs. Including weETH strengthens ETHplus by diversifying collateral, removing liquidity bottlenecks and alleviating existing concentration risks. The addition is designed to improve scalability, enhance minting and redemption efficiency, and ensure ETHplus remains competitive as both a resilient collateral index and a yield-optimized instrument.

Problem Statement

The recent Liquidity Report highlighted that the liquidity of the ETHplus constituent collaterals has significantly degraded over the last quarter and is now affecting execution depth. Capital allocators are now unable to scale their ETHplus operations further because of the slippage incurred when operating at scale. This proposal aims start the conversation around adding weETH into the collateral basket in order to increase the executional depth and in doing so set a good foundation to allow ETHplus to scale towards nine figures.

The minting a redemption curves for ETHplus in Q3 and Q4 can be found in the Q4 Liquidity Report here.

Rational

Given most of the incumbent collaterals, apart from stETH, are now over-saturated, either displaying sub-optimal minting and redemption curves , are significantly contributing to dependency risks or a combination of the two we must now look outside of the current basket for liquidity and risk optimisation.

Since its inception, two and a half years ago, ETHplus has indexed only the most pristine LST collateral as per its original mandate. However, we are now struggling to find further LST collateral with sufficient liquidity to support the large operations of capital allocators and institutions. Instead of continuing to add longer-tail LSTs to the ETHplus collateral basket at single digit percentages which offer minimal liquidity benefits and additional risks this proposal aims to start discussion around amending the current mandate and to include Liquid Restaking Tokens, LRTs and add ether.fi’s weETH to the collateral basket.

Liquid Restaking Tokens and Ether.Fi’s weETH

LRTs are similar to LSTs in the sense that they both involve staking ETH on the beacon chain to help secure the network. However LRTs take it a step further, allowing this stake to then be restaked on protocols such as EigenLayer to secure additional protocols or services, these are known as Actively Validated Services, AVS. Compared with LSTs, LRTs introduce extra risks since slashing can also now occur at the AVS-level and it deepens the smart-contract / governance stack.

eETH specifically is ether.fi’s flagship and market leading Ethereum backed LRT with weETH being the wrapped non-rebasing variant, giving the benefit of stability in token quantity. It is this wrapped version that is most commonly used in DeFi, with it being able to be unwrapped into incrementally increasing amounts of eETH over time.

In brief, as eETH stakes natively with EigenLayer any ETH deposited into the protocol is first staked to Ethereum validators on the beacon chain, as it is with other LSTs, then restaked via EigenLayer. The yield received is a blend of Ethereum staking rewards (consensus issuance, priority fees and MEV) and Eigen AVS rewards. After any operator and protocol fees (10%) net rewards accrue to holders.

Asset Yield and Liquidity

weETH has a TVL of ~$11b, commands a 87.3% share of LRT TVL and includes ~140,000 unique holders each holding ~22 ETH on average and accounts for 46.82% of EigenLayer’s total TVL. The current yield is 3.34% with an average 30d yield of 3.04%.

weETH’s exit liquidity (ETH and its derivatives paired against weETH + the liquidity pool) sits at $386m with ~$300m from liquidity pool and the remaining $80m being available via DEX LPs with the Uniswap being the primary platform ($43.15m).

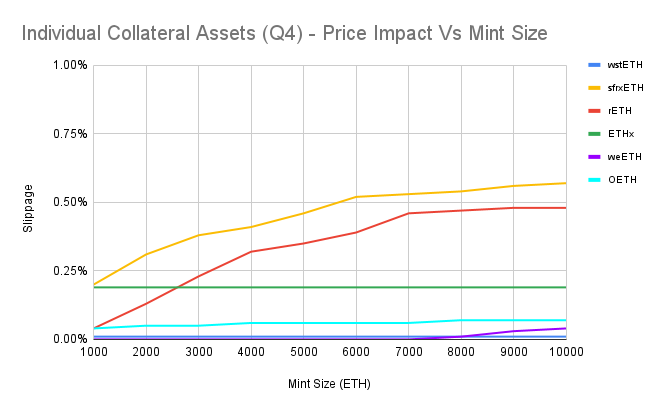

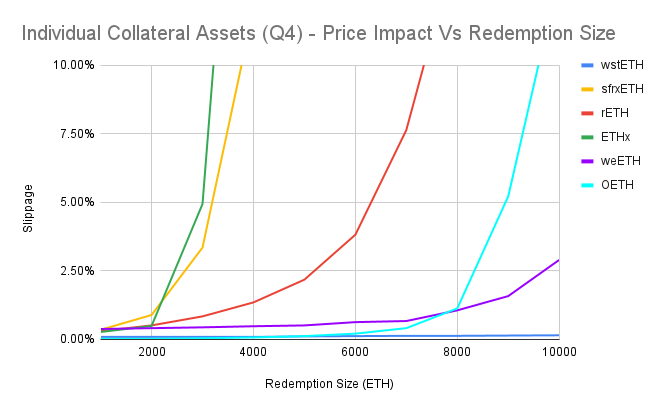

The impressive depth of weETH liquidity is well visualised when comparing to current ETHplus incumbents (stETH, rETH, sfrxETH and ETHx) and other available collateral plug-ins (OETH). Beating all in test apart from stETH for both mints and redemptions.

Risks

The risk profile of LRTs is unique and as such particular attention must be given to the additional risks they carry over their LST counter-parts. The list below is a summary and not exhaustive given there is some overlap between the risk profiles of these two asset classes.

Economic and Systemic Risks for LRTs

Additional slashing Risk. weETH restakes into EigenLayer, so in addition to Ethereum validator slashing they also inherit AVS-level slashing. Despite being isolated by EigenLayer’s ‘UniqueStake’ model the slashing risk is still larger than that of its LST counterparts.

Operator / AVS Concentration Risk. LRTs route stake to specific operators and AVS sets. Poor diversification or highly correlated AVSs concentrates risk and propagates losses across the LRT.

Stacked Smart-Contract Risk. LRTs layer additional contracts (LRT protocol, restaking interfaces, AVS interactions) on top of the base LST/validator stack, increasing upgrade, admin-key, and integration risk.

Market structure and Liquidity Risks

Exit and liquidity complexity Risk. LRT position exits can occasionally be longer than exits from their LST counterparts since the withdrawal queues stack. For example, when exiting weETH, if there isn’t enough liquidity in the Ether.fi liquidity pool the protocol will have to first exit AVS positions before joining the validator exit queue to complete the transaction. In the case of EigenLayer Pods this will add ~7 days onto a standard Ethereum validator queue exit. If a position requires an urgent exit Ether.Fi recommends exiting via DEX liquidity which will naturally affect peg stability if a large amount of capital exits over a short period of time.

Risk Mitigation

Given the layered risks that are intrinsic to all LRTs, security must be prioritised with institutional-grade reliability and a robust network of partners all contributing to the systems security framework. In the case of weETH these mitigations come via Ether.fi and EigenLayer, whose protocols secure $11b and $17.2b respectively. Each deployed system is subject to audits from premier auditing organisations, found below and immune.fi bug bounties (Ether.fi - $200k and EigenLayer $2m).

Ether.fi Audits are found here.

EigenLayer Audits are found here.

Current Basket

I’ve added the key metrics on the current basket weights and collateral liquidity here for reference before discussing the proposed basket. The graphs and tables have been reproduced from the Q4 Liquidity Report.

| Collateral Asset | Allocation | Yield (30d) | Basket Yield |

|---|---|---|---|

| wstETH | 50.00% | 2.64% | 1.32% |

| rETH | 21.00% | 2.32% | 0.51% |

| sfrxETH | 21.00% | 3.06% | 0.64% |

| ETHx | 8.00% | 2.68% | 0.22% |

| Total Yield Profile | 2.69% | ||

| Diversification Ratio | 0.66 |

| Collateral Asset | Total TVL (ETH) | Basket Allocation (ETH) | Percentage of Total TVL Held in ETHplus |

|---|---|---|---|

| wstETH | 8.54m | 45k | 0.53% |

| rETH | 635k | 18.9k | 4.2% |

| sfrxETH | 90k | 18.9k | 16.8% |

| ETHx | 161k | 7.2k | 4.74% |

Proposed Basket and Mandate Change

The current ETHplus mandate has severed EThplus well until now, supporting the inclusion of only the most pristine collateral into the collateral basket. However, ETHplus has now grown to such a size where pristine LST collateral can exclusively support the scalability of the product. I propose a change to this mandate which allows the inclusion of LRTs into the collateral basket in order to deepen execution depth and improve scalability.

Current mandate

The additional of weETH into the ETHplus basket currently goes against the ETHplus mandate:

- Maintain an Ethereum-aligned Liquid Staking Token basket.

- Positively impact the Ethereum staking distribution.

- Provide value to ETH+ holders through diversification.

Proposed mandate

‘To maintain an Ethereum-aligned liquid staking and re-staking token basket consisting of pristine collateral, positively impacting staking and staking distributions. The basket provides value to holders through diversification, over-collateralisation and risk-adjusted yield.’

Proposed Basket

| Collateral Asset | Allocation | Yield (30d) | Basket Yield |

|---|---|---|---|

| wstETH | 50.00% | 2.64% | 1.32% |

| weETHx | 25.00% | 3.04% | 0.76% |

| rETH | 15.00% | 2.32% | 0.51% |

| sfrxETH | 10.00% | 3.06% | 0.64% |

| Total Yield Profile | 2.79% | ||

| Diversification Ratio | 0.66 |

| Collateral Asset | Total TVL (ETH) | Basket Allocation (ETH) | Percentage of Total TVL Held in ETHplus |

|---|---|---|---|

| wstETH | 8.54m | 45k | 0.53% |

| weETH | 2.51m | 22.5k | 0.8% |

| rETH | 635k | 13.5k | 2.63% |

| sfrxETH | 90k | 9k | 7% |

The proposed collateral basket removes ETHx entirely and reduces the allocations to rETH (-6%) and sfrxETH (-11%) and replaces them with weETH at 25%. The primary aims of the allocation is to improve the basket’s yield profile, improve collateral asset liquidity and reduce the dependency risk of sfrxETH given ETHplus currently holds ~15% of the total supply.

As you can see from the graphs below, minting efficiency has almost increased by a factor of two and redemptions by a factor of five. Mints now exceed 1% slippage at 37,500 ETH (prev. 20,000) and redemptions at 12,500 ETH (prev. 2,500).

Conclusion

ETHplus TVL has exceeds the exceptions of many and has now reached the upper limit of it’s expected TVL given it’s execution depth and collateral asset dependencies. To improve the scalability of the asset new collaterals need to be added to the basket, as the largest LSTs have either already been indexed or don’t have enough on-chain liquidity broadening the mandate to include LRTs and adding weETH is a way to directly address these bottlenecks. The proposed basket materially improves execution depth—mints exceed 1% slippage at ~37,500 ETH (vs 20,000) and redemptions at ~12,500 ETH (vs 2,500)—roughly a 2× and 5× efficiency gain, respectively. Despite the clear benefits changing the mandate to include LRT collateral introduces additional risks (AVS-level slashing, stacked contract/governance surface, exit complexity) which must be weighed accurately before proceeding with this proposal.

Poll

I have chosen to not include a poll in this RFC at this time given the gravity of the proposal and the fact that the weETH plug-in is not yet live on the Reserve Protocol. Instead I encourage all governors to lend their voices to the discussion.

Due to the significant size of this rebalance it is unconfirmed if we are able to achieve the proposed basket in a single rebalance, if not a series of rebalances will be required. If there is general consensus for the mandate change and proposed basket I will use the comments to propose a rebalance roadmap on the weETH plug-in is live and poll governors at this time before progressing to on-chain vote.

Appendix

Data Collection

All of the data was collected via Llamaswap using the Odos and Paraswap aggregators, with the best price impact between the two being recorded.

For the price impact Vs mint / redemption size models for the ETHplus collateral basket accurate collateral basket allocations were used rather than an extrapolation of the mint and redemption curves for each collateral asset, ensuring accurate slippage values. The data used to model these graphs and other collateral baskets was collected on 05/09/2025 and can be found here.

Useful Links

Ether.Fi

Ether.Fi Docs

Ether.fi Audits

Ether.Fi Bug Bounty

Dune Dashboard - weETH Liquidity

weETH DeFiLlama

EigenLayer

EigenLayer Docs

EigenLayer Audits

EigenLayer Bug Bounty

Reports

DefiLlama Collateral Assest Assessment - weETH

Gauntlet LRT Dashboard

ThreeSigma LRT Deep Dive Series, Part 1 - 4