This report aims to provide a comprehensive update of all dgnETH related activities over the last quarter, including both on-chain and off-chain data. The purpose of this report is to inform and educate the wider Reserve community on the activities of dgnETH over the last quarter while becoming a reference library for all governance, social media and on-chain data.

Summary

- A poor quarter for dgnETH with most metrics sliding to levels lower than the close of the first quarter.

- Capital exits from both sides of dgnETH’s two token model with dgnETH losing ~2,000 ETH, a 70% drop and dgnETH ~1,600 ETH.

- Multiple collateral basket changes this quarter as Origin’s OETH and RE7’s Morpho WETH Vault competed for allocation.

- A marked decline of 32% in ETH supply at the single venue available the supply dgnETH, the dgnETH/ETH+ Curve LP.

- A successful quarter for X growth metrics beating Q1 and Q2 metrics combined despite other core metrics lagging.

Questions for the community

The flavour of the next quarter for all ETH Yield DTFs is how to expand DeFi supply either through existing or new partnerships, deepening their DeFi compostability. Unlike ETHplus, the venues to supply dgnETH to are limited with the only active LP being the dgnETH/ETH LP on Curve and no integrations with lending protocols. Where else would you like to see dgnETH supplied, and how would you integrate it?

Full Report

dgnETH Core Metrics

| dgnETH Core Metrics | Close of Q1 | Close of Q2 | Delta (Q2/Q1) | Close of Q3 | Delta (Q3/Q2) |

|---|---|---|---|---|---|

| Price ($) | $1,593.00 | $2,535.00 | 59.13% | $3,870.00 | 52.66% |

| Market Cap ($) | $3,673,458 | $13,000,000 | 253.89% | $7,082,100 | -45.52% |

| ETH Supply | 2,306.00 | 5,313.00 | 130.40% | 1,830.00 | -65.56% |

| Staked RSR ($) | $131,820 | $780,000 | 491.72% | $166,000 | -78.72% |

| Staked RSR ($RSR) | 21,970,000.00 | 114,400,000.00 | 420.71% | 26,630,000.00 | -76.72% |

| Total TVL | $3,805,278 | $13,780,000 | 262.13% | $7,083,232 | -48.60% |

| RSR Backing | 5.00% | 7.00% | 40.00% | 3.00% | -57.14% |

| RSR Staking Yield | 10.50% | 5.80% | -44.76% | 4.80% | -17.24% |

| Diversification Ratio | 37.50% | 37.50% | 0.00% | 42.00% | 12.00% |

A poor quarter for dgnETH with most metrics sliding to levels lower than the close of the first quarter.

In Q3 we have seen dgnETH significantly under-perform, most notably in the market cap of the asset which has dropped from $13m to $7m, a drop of 45.5% despite dgnETH price appreciation of 52.6%. The leading metric here is ETH supply which has unfortunately dwindled to 1,830 ETH, a drop of 65.6% on the quarter and 22% from the close of Q1. The result of this metric falling faster than the appreciating ETH price is a falling market cap and staked RSR metrics given falling RSR yields.

Staked Vs Unstaked Metrics

| Staked dgnETH (sdgnETH) Core Metrics | Close of Q1 | Close of Q2 | Delta (Q2/Q1) | Close of Q3 | Delta (Q3/Q2) |

|---|---|---|---|---|---|

| dgnETH Unstaked | $1,443,258 | $6,801,405 | 371.25% | $4,044,150.00 | -40.54% |

| dgnETH Unstaked (ETH) | 906 | 2,683 | 196.14% | 1,045.00 | -61.05% |

| dgnETH Staked | $2,230,200 | $6,667,050 | 198.94% | $3,037,950.00 | -54.43% |

| dgnETH Staked (ETH) | 1,400 | 2,630 | 87.86% | 785 | -70.15% |

| Percent of dgnETH staked | 60.71% | 49.50% | -18.46% | 42.90% | -13.34% |

| sdgnETH Price relative to ETH | 1.08 | 1.11 | 2.78% | 1.13 | 1.80% |

| Collateral basket yield | 8.68% | 4.52% | -47.93% | 2.23% | -50.66% |

| Yield Multiplier | 1.70 | 1.83 | 7.65% | 2.33 | 27.32% |

| sdgnETH Yield | 13.60% | 14.70% | 8.09% | 5.20% | -64.63% |

| sdgnETH Yield (30d) | New Data | 7.90% | New Data | 4.90% | -37.97% |

Capital exits from both sides of dgnETH’s two token model with dgnETH losing ~2,000 ETH, a 70% drop and dgnETH ~1,600 ETH.

These metrics focus on the two sides of dgnETH with each catering to investors with very different risk profiles and yield expectations, it is therefore surprising that we have seen such deterioration in both.

The drop in supply to sdgnETH isn’t surprising for a few reasons; mainly the drop in sdgnETH yield, falling 64.6% to 5.2% and the frustrations on the manual harvesting and processing of sdgnETH yield that when missed has led to a handful of reward cycles with no yield.

The supply drop in dgnETH, dropping 61% to 1,045 is harder to explain. Given the only venue to earn yield on dgnETH is the dgnETH/ETH+ LP it’s presumed that all dgnETH not staked would be supplied there. However, the rate of return and the risk profile of supplying capital here is relatively unchanged from the assets inception. Coupled with the fact that this yield strategy is for those that are willing to ‘set and forget’ and not hunt yield onchain it’s surprising to see this drop in supply. One reason that may explain this drop may be the concerns around the LSt withdrawal queue and subsequent increased risk of a deep and sustained stETH may have motivated liquidity providers to remove their assets given the LST exposure predominantly through ETHplus who have not returned to provide liquidity here again.

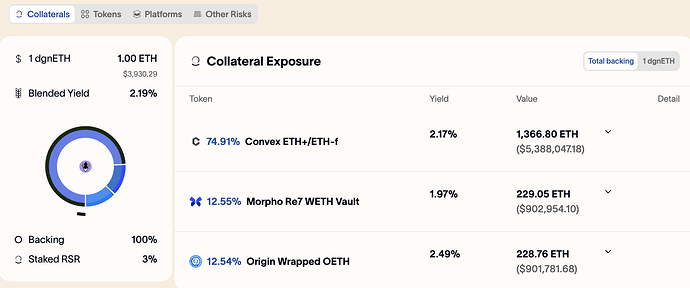

Current dgnETH Collateral Basket

| Collateral Asset | Allocation | Yield | Basket Yield |

|---|---|---|---|

| Convex ETH+/ETH LP | 75.00% | 2.21% | 1.66% |

| Morpho Re7 WETH | 12.50% | 2.04% | 0.26% |

| Origin OETH | 12.50% | 2.52% | 0.32% |

| Total Yield Profile | 2.23% | ||

| Diversification Ratio | 42.19% |

Multiple collateral basket changes this quarter as Origin’s OETH and RE7’s Morpho WETH Vault competed for allocation.

The dgnETH collateral basket changed significantly this quarter. Firstly, the Morpho RE7 WETH vault was swapped out for Origin’s OETH citing a more favourable yield profile as the main argument for the change. RE7 then reproposed sharing the 25% allocation, 12.5% each, citing the deviation from the dgnETH mandate to beat LST yields as the reason for the change.

Token Holder and Transfer Metrics

| Token Holders and Transfers | Close of Q1 | Close of Q2 | Delta (Q2/Q1) | Close of Q3 | Delta (Q3/Q2) |

|---|---|---|---|---|---|

| dgnETH Holders | New Data | 42.00 | New Data | 45 | 7.14% |

| dgnETH Stakers | New Data | 28.00 | New Data | 26 | -7.14% |

| dgnETH Transfers (90d) | 562.00 | 417.00 | -25.80% | 329 | -21.10% |

| dgnETH Total Transfers | 1,897.00 | 2,250.00 | 18.61% | 2669 | 18.62% |

Token holder and transfer metrics correlate the poor performance seen among the core metrics with falling dgnETH staker and 90d transfer metrics.

DeFi Integrations

| Curve dgnETH | Close of Q1 | Close of Q2 | Delta (Q2/Q1) | Close of Q3 | Delta (Q3/Q2) |

|---|---|---|---|---|---|

| dgnETH / ETHplus | |||||

| Total TVL | $2,480,000 | $4,685,000 | 88.91% | $4,944,775 | 5.54% |

| dgnETH Supply (ETH) | 381 | 915 | 140.17% | 533 | -41.75% |

| ETHplus Supply (ETH) | 381 | 915 | 140.16% | 707 | -22.73% |

| Auto-Compounding Vaults | |||||

| Yearn Finance | $260,000 | $465,983 | 79.22% | $632,185 | 35.67% |

| Yearn Finance Yield (30d) | New Data | 9.32% | New Data | 6.00% | -35.62% |

| StakeDAO | $334,000 | $722,470 | 116.31% | $1,077,675 | 49.17% |

| StakeDAO Yield (30d) | New Data | 8.32% | New Data | 6.00% | -27.88% |

| Convex | $1,250,000 | $3,545,128 | 183.61% | $3,385,516 | -4.50% |

| Convex DAO Yield (30d) | New Data | 7.26% | New Data | 6.20% | -14.60% |

A marked decline of 32% in ETH supply at the single venue available the supply dgnETH, the dgnETH/ETH+ Curve LP.

The dgnETH/ETH+ LP on Curve closed out the quarter down on the previous quarter with a decrease in total ETH supply of 32%. As mentioned previously this is surprising given the yield and risk profiles of the position are relatively unchanged since the assets inception.

It’s worth noting here that, at the time of this snapshot, dgnETH yields are higher than sdgnETH yields with Convex the highest yielding auto-compounding vault, yielding 6.2% Vs sdgnETH’s 5.8%. However, with the proposal to swap the convex allocation to the new stableswap pool I expect this to swing back into sdgnETH’s favour in the coming weeks.

The tracked DeFi integration metrics highlight dgnETH’s dependence on a single LP. Integrating both dgnETH and sdgnETH may be a good avenue for growth and stability through the next quarter.

Governance

Proposal 1 - Collateral Basket Change Proposal: Adding Wrapped OETH (wOETH) to the dgnETH Collateral Basket

Total unique commenters - 1

Off-chain Poll - 8 votes (4 for / 4 against)

Total RSR voted - 9m (9m for / 0m against)

Proposal 2 - Collateral Basket Change Proposal: Add Re7 WETH Morpho Vault

Total unique commenters - 2

Off-chain Poll - 5 votes. (3 for / 2 against)

Total RSR voted - 4.2m (4m for / 204k against)

Proposal 3 - Collateral Basket Change 6: Re-introduction of apxETH

Total unique commenters - 1

Off-chain Poll - 2 votes. (2 for / 0 against)

IP

This proposal did not graduate to IP.

Social Media

This section looks at the data surrounding the dgnETH X account only

| Social Media Metrics | Close of Q1 | Close of Q2 | Delta (Q2/Q1) | Close of Q3 | Delta (Q3/Q2) |

|---|---|---|---|---|---|

| Posts | 49 | 22 | -55.10% | 37 | 68.18% |

| Impressions | 4,370 | 1,230 | -71.85% | 5930 | 382.11% |

| Profile Clicks | 30 | 10 | -66.67% | 61 | 510.00% |

| Followers | 209 | 202 | -3.35% | 211 | 4.46% |

A successful quarter for X growth metrics beating Q1 and Q2 metrics combined despite other core metrics lagging.

Social media metrics are up significantly across the quarter with a 68% increase in posts, a 382% growth in impressions and a 4.4% rise in followers beating the Q1 and Q2 metrics combined. The growth across social media can be attributed to the success of X-posting with partners, something which should continue into Q4.

Most Viral Tweet of the Quarter

Conclusion

Q3 was a challenging quarter for dgnETH, with most metrics declining despite underlying ETH price appreciation. Both staked and unstaked supply contracted sharply, market cap fell, and RSR metrics dropped as yields shrank. At the same time, dgnETH’s dependence on a single LP remains a key limitation as does the volatile yield distribution. On a more positive note, governance remained active, collateral basket changes were implemented, and social media reach grew substantially, demonstrating an undeterred community. Looking ahead, the priority is clear: deepen DeFi integrations and smooth yield distributions to support long-term growth.

Finally, if you’ve enjoyed this report and consider me, Ham, a valued steward of the dgnETH Yield DTF please consider delegating your voting power to me to ensure your voice is always represented in Reserve governance. I’m an independent delegate who, since my delegation platform began in July 2025, hasn’t missed a Yield protocol governance vote. You can find more information on my delegation platform.

TG: @hamdefi

Discord: Ham6869