Summary

This proposal seeks to add the Re7 WETH Morpho Vault back into the dgnETH collateral basket.

Current dgnETH Collateral Basket:

| Collateral Asset | Allocation | APY |

|---|---|---|

| wOETH | 25% | 2.52% |

| Convex ETH+/ETH | 75% | 4.41% |

| Total APY | 3.94% | |

| sdgnETH APY | 6.91% |

Diversification Ratio: 0.375

Proposed dgnETH Collateral Basket:

| Collateral Asset | Allocation | APY |

|---|---|---|

| Re7 WETH Morpho | 12.5% | 3.16% |

| wOETH | 12.5% | 2.52% |

| Convex ETH+/ETH | 75% | 4.41% |

| Total | 4.01% | |

| sdgnETH APY | 7.04% |

Diversification Ratio: 0.406

Note: Asset APY’s were taken from the Reserve APP.

Abstract

Our analysis indicates the recent collateral basket change proposal has caused dgnETH to diverge away from its mandate.

This proposal aims to align the dgnETH collateral basket more closely with its mandate while increasing the yield profile and the diversification ratio.

At Re7 Labs, we’re dedicated to empowering the Decentralized Finance (DeFi) ecosystem. Active since 2019, we’ve established ourselves as an institutional-grade liquidity provider and experts in risk curation and vault management. We utilize our specialized in-house tools and research to enhance liquidity and user experience across DeFi protocols, managing over $550 million in our curated vaults.

Problem Statement

The dgnETH mandate:

1: Take appropriate risks to capture high DeFi yields and sustainably outperform the LST market. 2: Distribute revenue to maximize staking contract yield.

According to the first part of the mandate, the goal of dgnETH is to sustainably outperform the LST market. By adding wOETH(an LST) in the collateral basket at a 25% allocation, only 75% of the collateral basket will be able to sustainably outperform the LST market. 25% of the collateral basket will offer returns equal to the LST market.

There is a noticeable deviation between the dgnETH collateral basket and its mandate.

Rationale

There are two main avenues for ETH yield in the DeFi space that can sustainably outperform the LST market. Lending Vaults and Liquidity Pools.

Liquidity Pools(Convex) :

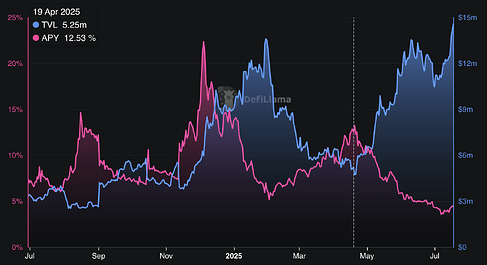

Convex Finance enhances the rewards for Curve liquidity providers by offering additional CVX token incentives. The ETH+/ETH pool on Convex delivered impressive yields over the past year, exceeding 20% and reaching a high of 12.53% in April 2025.

Graph of TVL and APY from defillama of ETH+/ETH Convex chart:

Lending Vaults(Morpho) :

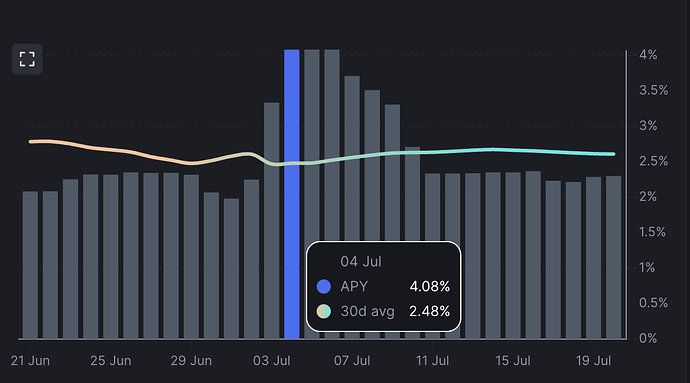

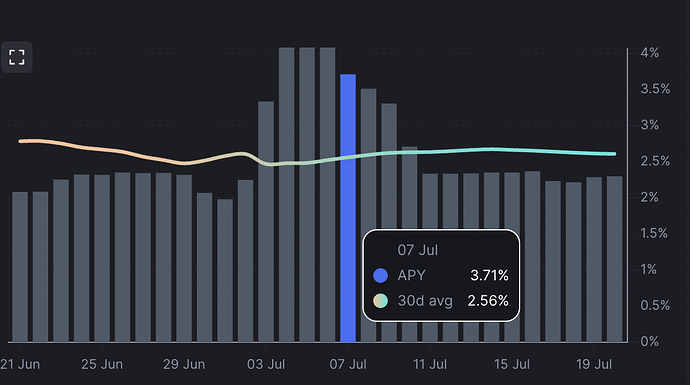

Morpho vaults are structured to ensure that capital is actively used, minimizing idle time and maximizing the productive use of deposited funds, which in turn translates to higher yields for lenders. Yields for the RE7 WETH vault touched 12% APY in the last year, including a high of 5.63% in June 2025.

Graph of TVL and APY from defillama of the RE7 WETH Morpho Vault:

LSTs offer lower yields compared to the returns from providing liquidity to pools or supplying assets to lending markets. LST exposure should be kept to an absolute minimum if the dgnETH collateral basket aims to align with the mandate.

This proposal aims to enhance sdgnETH’s yield, increase the diversification ratio and better align the collateral basket with its mandate.

Risks

Governance risk is our primary concern. There is a mandate that governors have deviated from. If this deviation continues to grow, dgnETH could lose its clear framework of rules for future governance proposals. It is recommended that governors support this proposal to begin to realign themselves with the mandate and prevent further deviation.

- Yay

- Nay