Summary

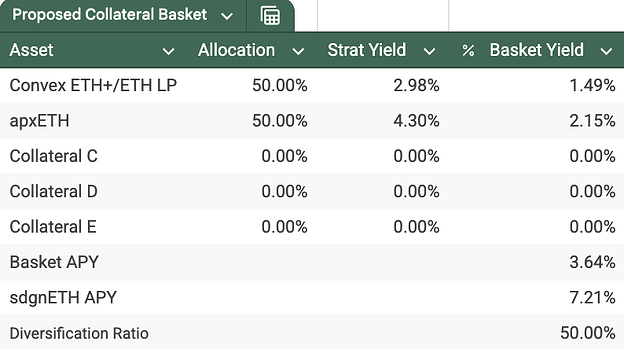

This proposal reintroduces apxETH to the dgnETH collateral basket, replacing lower-yielding assets and reducing the ETH+/ETH LP. The change boosts blended yield from 2.87% to 3.65%, raises sdgnETH yield to 7.2%, and improves diversification from 41% to 50%, strengthening dgnETH’s mandate of yield optimisation and diversification.

Problem Statement

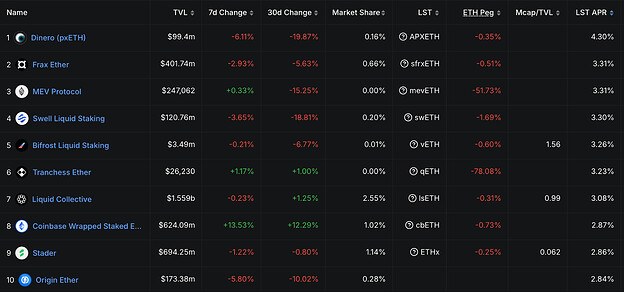

The dgnETH collateral basket has recently fallen out of compliance with it’s mandate for two reasons; the inclusion of Origin’s OETH limiting the baskets ability to beat LST yields and the fact that current dgnETH collateral basket isn’t optimised for yield given there are higher yielding collaterals available to it, Dinero’s apxETH yielding 4.3%, which aren’t currently deployed in the basket.

Dinero’s apxETH

apxETH is no stranger to the Reserve Protocol with it previously being included in the dgnETH collateral basket, proposal found here and a previous RFC to include it in the ETHplus collateral basket which didn’t graduate to the on-chain voting stage. The latter includes an excellent write up on apxETH if you want to get up to date on the assets mechanics.

Rationale

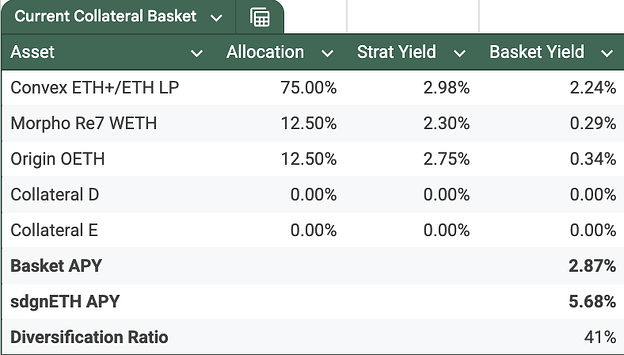

The addition of apxETH to dgnETH’s collateral basket aims to satiate dgnETH’s hunger for yield increasing the collateral baskets blended yield from 2.87% to 3.65% and sdgnETH’s yield from 5.68% to 7.2%.

While apxETH is still an Ethereum LST it’s two-token model has enabled it to consistently outperform the markets average LST yield and remains the highest yielding collateral available to dgnETH.

Basket Changes

The collateral basket change proposed removes the two lower yielding collaterals; OETH and the RE7 Morpho Vault and reduced the ETH+/ETH LP to 50% in favour of the higher yielding apxETH. These changes also increase the diversification ratio from 41% to 50%.

Risks

The proposed changes concentrates counter-party risk in the two remaining collateral assets however the diversification ratio is increased and both protocols have undergone rigorous audits and are sufficiently lindy to warrant the allocation in the dgnETH collateral basket.

Dinero Audits and Security Partnerships

Conclusion

Reintroducing apxETH into the dgnETH collateral basket directly addresses mandate compliance by replacing lower-yielding assets with the market’s highest-performing LST. While this increases the percentage of the basket that is allocated to LST yield the change raises yields and improves diversification ensuring dgnETH continues to deliver on its north star, yield optimisation.

Poll

- Yay, proceed with the basket rebalance

- Nay, no change to the collateral basket