Welcome to the Q2 2025 quarterly report for High Yield USD (hyUSD), designed to provide a comprehensive snapshot of the project’s performance and ecosystem developments. This report dives into key metrics, including governance activities across the forums and onchain, TVL(Total Value Locked) trends, critical DeFi metrics, and evolving social media engagement. By presenting these insights, our goal is to keep the hyUSD community well-informed, foster transparency, and encourage active participation in the ongoing growth and success of hyUSD.

Current hyUSD Collateral Basket:

| Collateral Asset | Allocation | Yield |

|---|---|---|

| Aerodrome eUSD/USDC LP | 50% | 4.2% |

| Comp v3 USDC | 25% | 3.9% |

| Aave v3 USDC | 25% | 4.8% |

| hyUSD APY | 3.5% |

Summary: This section highlights the current collateral basket and the yield profile of hyUSD. Quarter over quarter the hyUSD APY has increased from 3.3% to 3.5%, while not an extreme change, it is definitely a good sign to see positive growth in this metric. 50% of the collateral basket is composed of the eUSD/USDC LP position on Aerodrome. The underlying yield for this position comes in the form of the AERO token, and one factor that drives the APR for this pool is ultimately dependent on the AERO price as well as the amount of vote weight(veAERO) that directs incentives to this pool. Q2 has been a good quarter for the AERO token, finding its low around $0.31 in early April to a high up to $0.80 at the close of the quarter. This has positively impacted the underlying APR for this position which has attributed to the overall growth of hyUSD’s APY quarter over quarter.

hyUSD Market Cap, TVL, and Other Core Metrics:

| Metric | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| Price ($) | $1.083 | $1.091 | +0.74% |

| Market Cap ($) | $4,113,066 | $4,134,931 | +0.53% |

| hyUSD Yield | 3.32% | 3.51% | +5.7% |

| hyUSD Supply | 3,797,845 | 3,790,038 | -5.5% |

| Staked RSR ($) | $505,717 | $477,495 | -5.5% |

| Staked RSR (RSR) | 80,528,331 | 70,219,931 | -12% |

| Total TVL | $4,618,783, | $4,612,426 | -0.14% |

| Overcollateralization (%) | 13% | 15% | +15% |

| RSR Staking Yield | 5.4% | 5.8% | +7% |

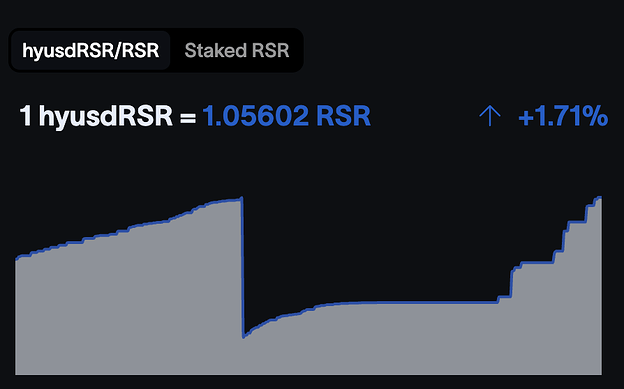

Summary: The metric to focus on in this section is the RSR staking yield, not only has there been a growth of 7% quarter over quarter but hyusdRSR just put in a new all time high. In the last report I put together a detailed breakdown of the slashing event on what happened, what went wrong, and what steps can be taken in the future to try and prevent this. Several RSR stakers were quite frustrated(rightfully so) with such a large slashing event during the governance led rebalancing. But for the RSR stakers that decided to “stake the dip” have been rewarded. Even though there has been a decrease by 12% in the number of RSR stakers, the overcollateralization remains healthy. The decrease in the number of stakers was likely two fold. 1) There were individuals that unstaked after the slashing event and 2) There was a period of time when auctions were not running to completion due to an auction participant not executing the auction transactions correctly. As of May 1st the auction participant has been executing transactions to completion so that all revenue is realized and distributed to all parties. During the time when auctions were not running to completion the revenue was still accumulating. The chart below is a testament to RSR stakers being committed and aligned with hyUSD and its mission and the future looks starry. Congrats to new ATH hyusdRSR holders.

DeFi and Onchain Metrics

Transactions and Holders on Base

| Metric | Q1 | Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| Holders | NA | 8,228 | NA |

| Total Transactions | 15,282 | 11,533 | -24% |

Integrations

Morpho

| Morpho Re7 eUSD Vault | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| hyUSD Supplied | $1,950,0000 | $1,970,0000 | +1% |

| Supply Cap | NA | $2,000,000 | NA |

| Utilization | NA | 80% | NA |

Aerodrome

| hyUSD/eUSD Basic Volatile Pool: | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| hyUSD Supplied | $1,950,0000 | $1,767,665 | -20% |

| eUSD Supplied | $2,100,000 | $1,743,407 | -32% |

| Total Pool TVL | $4,200,000 | $3,509,460 | -26% |

Summary: Quarter over quarter we have seen a slight decline across most metrics in this section. The one metric that did show positive growth quarter over quarter is a slight increase in the supply to the Re7 eUSD Vault on Morpho. With the supply cap at $2M and the hyUSD supply at $1.97M, the supply caps might need to increase as more demand comes in.

For the yieldoors on Morpho, the current borrow rate in the hyUSD/eUSD market is at 1.44% APY, and the hyUSD APY is at 3.5%. There is a profitable looping strategy for anyone looking to increase your yield. With LTV at 86%, looping up to seven times will yield an APY of about 14%. Play the spread safely and be careful of slippage.

Governance:

Proposal 1: hyUSD Backing Buffer Change to 0.15%

Views: 58

Off-chain Poll - 5 votes (5 for / 0 against)

Onchain Poll:

Quorum: 7M RSR

Voter Turnout - 16M (16M for / 0 against)

Unique Voters: 2

Outcome: Proposal Passed

Summary: The hyUSD Backing Buffer Change to 0.15% proposal was discussed in detail in the last quarterly report because the RFC hit the forums in Q1. However, the onchain poll went live in Q2 and passed.

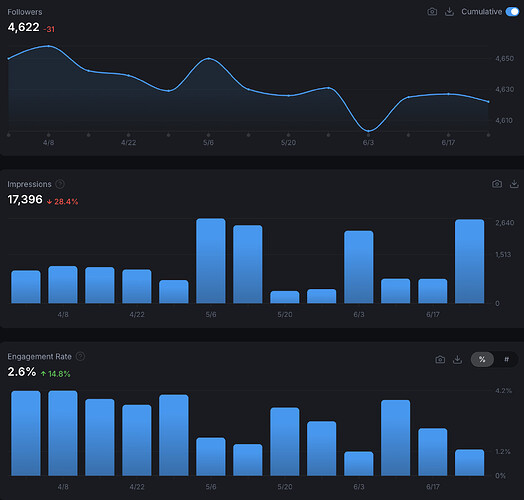

Social Media

| Social Media | Close of Q1 | Close of Q2 | Delta (Q2/Q1) |

|---|---|---|---|

| Posts | 63 | 65 | +3.7% |

| Impressions | 27,000 | 17,396 | -35% |

| Engagement Rate | 2.3% | 2.6% | +14% |

| Followers | 4,653 | 4622 | +0.67% |

Summary: The engagement rate seeing a 14% growth quarter over quarter is the most significant. From 2.3% in Q1 to 2.6% in Q2 while impressions declined is a sign that the hyUSD community remains strong. The regular post cadence stayed the same with about the same number of posts. The content posted on this account highlights the different yield opportunities on base, and seeing the engagement rate spike this quarter demonstrates that the content strategy and post cadence is effective.

Conclusion:

That concludes the Q2 2025 report. Comment below any questions and comments you might have and make sure to stay up to date on all things hyUSD by following the X account here:

Disclaimer: This is everything that happened, a celebration of the community and an invitation to participate in the ongoing success of hyUSD. Continue to participate in the gov ops call, continue to participate on the forums and in onchain votes.

hyUSD: created on the Reserve Yield Protocol ![]()