1. Summary

-

Problem: RSR’s structure distorts key metrics and concentrates control. The idle supply inflates valuation optics. Offchain governance dulls engagement and trust, deterring external talent and concentrating value capture responsibility within the central team.

-

Solution: Introduce and budget a veRSR-governed tail-emission model and transparent treasury accounting to decentralize control, align incentives, and make value capture verifiable and distributed. Empower the community to operate as productive capital.

-

Outcome: Burn unused supply (estimated ~30 billion RSR), re-engage external capital and builders, and transform RSR’s monetary framework into a transparent, community-owned engine for durable growth.

Fear, uncertainty and doubt grows in the void left by implementation gaps and the erosion of shared ownership. This proposal aims to offer solutions to fill that void.

2. Introduction - Why Now?

I’ve been part of the Reserve ecosystem for seven years. First as a seed investor, then Head of Ecosystem Growth, and now as an independent community contributor to the OPEN Stablecoin Index DTF.

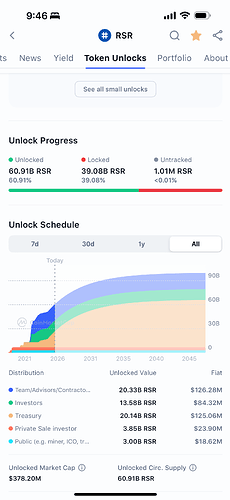

The Reserve Rights (RSR) token governs the Reserve ecosystem. When vote-locked or staked, RSR grants Decentralized Token Folio (DTF) governance rights and a share of DTF fees. For Stablecoin and Yield DTFs, RSR also provides first loss capital. RSR does not yet govern its own treasury, with (at least) ~41% of supply held in company wallets here, here, and here.

Roughly 4.4 billion RSR are staked across DTFs from ~300 wallets, with governance participation often below five voters per proposal for the largest DTFs. A concerning share of staking and voting activity originates from company-linked wallets, as explained in Problem, section 3.2 below. The cited figures can be independently verified via the governance tab for each DTF on app.reserve.org.

In putting together this proposal, the OPEN Stablecoin Index provides a helpful analytical lens for evaluating RSR vs its peers on a relative basis. This is similar to how the market (capital, talent, partners) assess where to spend their limited time and money!

Here in Table 1, you’ll get a glimpse into how 13 comparable ecosystems differ from RSR in ways that might help contextualize this proposal.

Table 1:

You can view the more detailed dashboard here.

Before continuing, it’s important to acknowledge every current and past Reserve contributor, investor, and community member. The project’s longevity exists because of your conviction, and a belief in the potential of “Reserve Rights.”

Also recognizing the livelihoods intertwined with RSR’s future, from contributors to the global underbanked it aims to serve. This proposal is written in that shared conviction to safeguard RSR’s long-term health.

This proposal is meant as a conversation starter. It does not pretend to be precise, final and scientific. Ask questions, flag risks, and build on what’s useful. With luck, a thoughtful and open community dialogue will emerge.

3. Two Core Problems

RSR’s health today centers on two structural issues that shape how it’s perceived and governed.

3.1. Excess Authorized Supply (Metric Distortion)

A large portion of RSR remains authorized but unused, inflating the fully diluted valuation (FDV) without contributing to productive activity.

-

This weakens RSR’s TVL-to-FDV and several other efficiency ratios compared to peers.

-

The distortion is optical, not fundamental, yet capital allocators often filter opportunities on headline FDV alone.

-

As investor Jon Charbonneau observed: “Many funds simply use the headline FDV. We know it’s misleading, but that’s the reality.”

As a result, RSR appears overvalued and underperforming (see Table 1 above). If you’re talent or capital, how do you weigh the opportunity cost of joining and staying in the lowest TVL-to-FDV ecosystem versus the median or top-tier performers?

3.2. Ownership Alignment in Emissions Governance

Company wallets control at least 41% of RSR supply. Treasury allocation decisions remain offchain and opaque, including investment into other portfolio companies that do not accrue value to RSR.

RSR’s manually managed emission curve mirrors Bitcoin’s predictability in form but misses its onchain transparency, adaptability, and proof-of-work distribution in substance. This is foundationally problematic.

RSR currently captures little verifiable value from its treasury, emissions, or investments due to this structure which also introduces three systemic concerns:

-

Dump risk from a single dominant holder.

-

Company-linked wallets outvote independents (example, illustrated), causing governance disillusionment (example)

-

Builders hesitate to build atop RSR when value leaks elsewhere.

As a serious builder or integrator, how do you justify building vital infrastructure atop RSR’s opaque operations and neutered ownership? Deployers could launch a DTF with their own governance token, but why not make RSR itself the most compelling foundation?

4. RSR in the Indexing Landscape

RSR is optional as a governance token on DTFs although fees from all DTFs buy and burn RSR.

Major fintechs, CEXs, and ETF issuers are accelerating into crypto indexing. Crypto.com Baskets, BlackRock iShares ETHA, and Bitwise Indexes are part of the wave. Many will remain centrally managed, reflecting Web2 design and legal structures.

Kraken stands out for hedging both worlds, running centralized Kraken Bundles while supporting the onchain CF Large Cap Index DTF utilizing CF Benchmarks data, its own subsidiary.

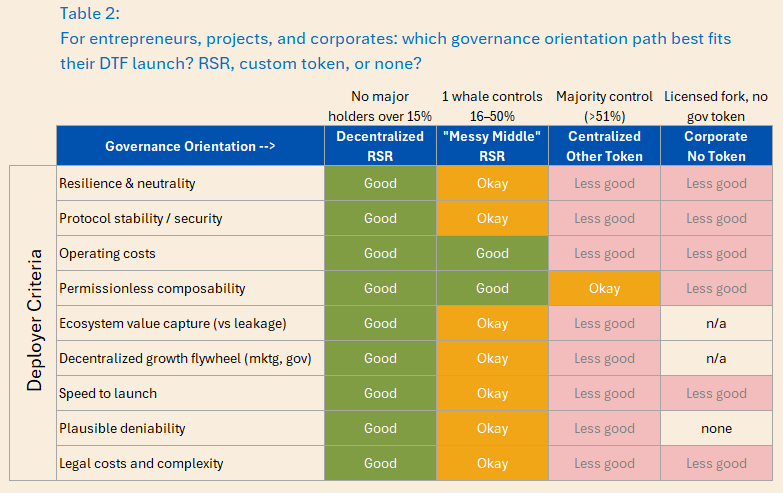

The following section highlights criteria and tradeoffs for onchain DTF builders designing governance and value flows. It offers context for potential RSR integration rather than a prescriptive checklist.

Reserve’s edge likely lies in serving DTF deployers who need resilience & neutrality, permissionless composability, plausible deniability, rapid market entry, or some degree of decentralized governance and marketing.

RSR health likely plays a pivotal role in realizing this edge.

5. Peer Context

Across crypto, top ecosystems are rethinking their token models to balance flexibility, transparency, and community alignment.

-

HYPE ($36B FDV) is wrestling its own similar metric distortion and considering a token burn and either removing the max supply cap to allow ongoing emissions, or maintaining the cap and addressing potential ecosystem growth fund shortages later when market sentiment changes.

-

FRAX ($134M FDV) is replacing its capped model with a tail-emission schedule governed by veFRAX holders. This ensured predictable long-term incentives while allowing veFRAX holders to govern how emissions are allocated. It effectively gave Frax a flexible, decentralized monetary policy that adapts with market conditions.

-

ETH ($470B FDV) transitioned to a proof-of-stake, adaptive emissions framework in 2022 that adjusts validator rewards to network conditions while burning a portion of transaction fees. Its net issuance rate currently tracks below Bitcoin’s. The Ethereum Foundation’s treasury is centrally managed but holds less than 1% of total ETH supply.

By comparison, RSR ($601M FDV) follows a Bitcoin inspired structure, but without the open and verifiable onchain features that made Bitcoin’s model credible.

6. Proposal: Modernizing RSR’s Monetary Logic

Objective: Reduce inflated FDV, improve economics legibility, and integrate community ownership with emissions governance.

Proposed Steps:

-

Publish treasury data: Confusion Capital and ABC Labs to disclose historical allocations and forward forecasts to guide emissions planning for a veRSR system. Learn more about veTokenomic systems here.

-

Model veRSR capital needs: Confusion Capital and ABC Labs forecast bull and bear scenarios to determine N-month prefunding for veRSR. Publish with a request for community comments.

-

Create an independent discretionary fund: Establish a fund to support near-term RSR ecosystem priorities in research, regulatory policy, and crisis response, replacing the Slow and Slower Wallets. Portfolio company investments that do not accrue value to RSR should seek external funding sources.

-

Introduce tail emissions via veRSR: Replace the fixed supply cap with a flexible schedule governed by veRSR holders.

-

Burn excess RSR (estimated ~30B): Remove unused supply to improve RSR health ratios and signal credible scarcity.

-

Mandate governance justification: All new resource allocation proposals must include justification, projections, and receipts. veRSR would serve as the main funding engine for Reserve ecosystem initiatives driving TradFi, DeFi, and Retail adoption.

7. Expected Benefits

Market Credibility:

-

Lower FDV and transparent accounting improve core valuation ratios.

-

Clarity attracts credible analysts, capital, and builders.

Shared Governance & Ownership:

-

Integrates treasury and emissions with the community turning collective participation into productive capital.

-

Restores ownership legitimacy and empowers contributors to compound their impact.

Ecosystem Expansion:

-

Predictable monetary policy provides a way to onboard new ideas, expertise and capital.

-

Encourages new DTF deployers to adopt RSR as default governance infrastructure.

8. Success Metrics After 12 Months:

-

Market health: Improve RSR’s TVL-to-FDV ratio by at least 30% from today’s level.

-

Community alignment: 35% of circulating RSR vote-locked in veRSR, showing active, long-term commitment. (current comps: veCRV 40%, veFXN 67%)

-

Decentralized governance: Each major DTF (>$20M TVL) has 7 or more independent voters consistently. Voters may be delegated from the company’s RSR supply but must be community-elected and re-approved every six months through open renewal votes.

-

Community initiative: Excluding DTF basket changes, at least 10 community-led growth proposals inspired/submitted annually, with 2 or more adopted, backed with Reserve administrative & awareness support.

-

Transparency: 70%+ of funded proposals publish clear receipts and impact reports on how RSR capital was used.

-

Ownership distribution: Company wallets hold no more than 10% of total RSR supply.

Some may want on metrics like TVL or RSR token price, but forecasting them is futile in an emerging market under the weight of technical, operational, and regulatory risks. What we can shape are the inputs: our incentives, transparency, and participation. The outcomes ahead will reflect the integrity of what we build today.

9. Closing

The Reserve Protocol is now more efficient, composable, and secure than ever. But RSR’s health has stalled, and while an upcoming market upswing could mask the cracks, a future cooldown is likely to expose and magnify them.

First-impression metrics obscure the RSR ecosystem’s strength. External capital, builders, and integrators are under-engaged in the RSR flywheel.

Engaged capital creates outsized impact. They stake, govern, integrate, recruit talent, and shape outcomes through their networks. They identify risks early and lend credibility that attracts others. They function as an extended BD team and serve as one of the clearest signals of product-market fit and compounding momentum.

A refreshed governance model could calibrate emissions in real time, more reliably align dilution with growth, and restore confidence in RSR’s monetary framework. Onchain alignment between mission and operations secures this framework.

By reducing unused supply and improving transparency and governance, Reserve can fortify its credibility and deepen its community strength in tandem.

Founders often fear that sharing control with tokenholders slows execution and blocks shipping. The best founders should be trusted to move fast, but governance isn’t binary. There’s an efficient frontier where minimal rights and protections can meaningfully boost asset value and investor confidence without hampering agility.

A few high-leverage, low-cost governance trade-offs can unlock outsized upside. Traditional finance has long understood this equilibrium.

Accessible transparency compounds like interest. Shared ownership multiplies strengths. Together, they create durable value that keeps RSR healthy in every season.

We’ve outlined key problems and a potential path forward, open to refinement. What resonates or feels missing? Please add.