Thank you @0xJMG for putting the work in to draft the original proposal, your ongoing input and for kicking off a discussion which pales in depth to any other forum post I’ve seen. The amount of accounts specifically created to join this discussion is truly commendable.

While the comments contain some genuinely healthy debate and I am glad to see the team’s engagement (especially Nevin’s contributions), I am disappointed to see a handful of negative comments regarding the team and their output over the past 6 to 12 months. Firstly, I want to echo JMG’s point that the CMC20 is a huge step forward and represents a major achievement. We only see the surface of what was likely an enormous body of work to secure a flagship DTF partner, and having it presented above the fold on a site with close to 100m monthly visitors is something the entire ecosystem should celebrate wholeheartedly.

That said, the RSR Health discussion highlights several large issues. The most concerning for me is how RSR and its holders have become increasingly peripheral as the index protocol has grown. If we stay on the current trajectory, we risk creating structural problems that will be extremely difficult to unwind later, regardless of how strong the technology or distribution channels become. Below i’ve outlined my asterisks and caveats and after will move on to what I think a healthier future looks like for Reserve.

Centralised Governance Power

-

It is unclear what stake ABC Labs and CC have on each DTF and how much is delegated.

-

Proposals often pass with 3 to 6 governors, with little independent participation.

-

Concentrated and opaque voting power discourages community involvement, reduces decentralisation, and limits DTF resilience.

Poorly Structured Governance Flows

-

LCAP governors currently vote on basket rebalances before the benchmark is published by CFB.

-

This requires trust in third parties instead of independently verifiable information.

-

Despite this unconventional setup, there has been no formal education on how governors are expected to evaluate these rebalances. This is especially surprising given the LCAP vlRSR airdrop was designed to encourage wider participation.

RSR Burns

-

Although RSR burns are popular among the community, they are not celebrated, scheduled, or documented in a consistent way.

-

Current opacity creates unnecessary uncertainty and invites FUD at a time when burns could be a source of positive sentiment.

Fixed Platform Shares

-

The original plan for index DTFs was a 50 percent platform share that would gradually reduce as TVL milestones were hit. LCAP followed this, but CMC20 launched with a 33 percent share, a 35% reduction, with no conversation around if this will remain fixed or reduce as TVL milestones are hit.

-

The issue is not the change itself, adjustments are normal in a developing ecosystem. The issue is that changes to the core value accrual mechanism for RSR were not clearly surfaced to the community.

-

Without PMF and strong distribution, value accrual will naturally be limited for now, but clarity and predictability remains important for long-term holders and potential investors.

eUSD Mandate and Revenue Share Programme

The initial eUSD revenue share model served its purpose by establishing early traction, helping fintechs grow, and introducing a yield structure familiar from Web2. However, the current programme has several weaknesses that have not been addressed quickly or transparently.

-

Mandate clarity: The current mandate covers only basic stablecoin requirements. With no clear guidance on risk parameters, yield benchmarks, or over-collateralisation targets, the DTF is difficult to govern.

-

Fintech needs: Compounding the point above it is also difficult to govern without fintechs clearly communicating their preferences. For example, basket change proposal 5 concentrates more than 60 percent into RLUSD, but we do not know whether fintechs prefer diversification or concentration. This needs to be clarified before we can effectively govern.

-

Fintech Transparency: UC and Sentz have recently begun sharing quarterly updates, which is a positive step. However, it is unclear whether this cadence will continue consistently.

-

Over-collateralisation: UC has grown rapidly, increasing its eUSD balance from $4.3m to $6.4m last quarter. Without changes, continued fintech growth reduces over-collateralisation over time. There has been no public discussion on ideal over-collateralisation levels or the path forward once these thresholds are approached. I’d prefer a pro-active discussion on this rather than making the wrong decision reactively further down the line.

-

Governor Fatigue and Centralisation: I know this point has been hashed and rehashed on both the forums and during GovOp calls but I still think it’s worth discussing. The core argument against centres around ‘quorum is always reached so this isn’t really an issue’ but when governance is so centralised with 4-5 wallets voting on Revenue Share ratification votes which almost never contain a completely independent participant it’s a mute point. Independent community voters are fatigued or were never engaged and only institutional or incentivised participants remain.

-

Value accrual to eUSD stakers: Fintechs currently receive the benefits of governance and over-collateralisation for free. Although the 100 percent revenue share model made sense early on, there needs to be a roadmap that gradually balances value between fintechs and RSR stakers as fintechs mature.

Until these issues are resolved, eUSD remains an asset with limited transparency, centralised governance, growing operational complexity, and weak alignment with long-term value accrual for RSR. Once fixed, I believe eUSD can scale much further and onboard additional partners.

Siloed Index DTF Governance

We’ve now seen some of the market’s strongest ecosystem participants (CMC / Binance and Kraken / CFB) and VC and PE firms such as Venionaire Capital create index DTFs which in lieu of creating their own governance token have chosen RSR instead.

This approach is clearly a win-win: it allows DTF curators to avoid the operational overheads and legal exposure of creating a token, while also introducing another RSR sink that benefits the broader ecosystem. However, under the current structure there remains a significant disconnect with Reserve’s pre-existing network, as participants who want to co-own and contribute to a DTF still face a high barrier to action, one that only grows as more DTFs adopt RSR as their governance token, increasing choice and inadvertently amplifying decision paralysis. There is almost certainly a better way for DTF curators to tap into these existing network effects and engage hundreds of enthusiastic RSR holders, promoters, and governors from day one and shorten the Reserve’s ecosystem user funnel.

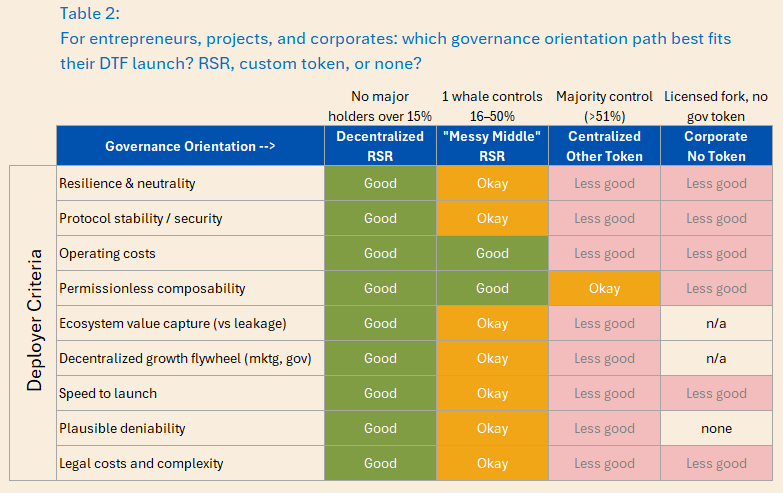

@0xJMG table on DTF governance orientation comes to mind here…

Education around new DTFs

-

The lack of structured education and onboarding during new DTF launches results in minimal co-ownership and limited understanding of who the DTFs curators are and what their index methodology is, $VLONE is a good example of this.

-

The RSR community is small compared to the broader distribution channels available to DTFs, but it remains a simple and predictable early adoption funnel.

-

The low governance participation and minimal activation for LCAP and CMC20 holders indicates that education and engagement efforts need improvement.

Taken on their own, many of the points raised above could be viewed as small weaknesses in an otherwise strong and forward-moving protocol. Looked at together, however, they highlight a direction that should concern anyone who wants RSR and its community to remain central to the ecosystem. If these issues are not addressed, we risk sliding toward a setup where governance becomes more centralised, governance decisions become harder for independent participants to influence, and the token’s core value accrual mechanism remains undefined. That kind of environment will continue to dissuade current governors, not attract new governors and also risks pushing existing community members further to the sidelines, increasing their bias to action.

The encouraging part is that this is fixable. The level of engagement in this thread shows that the community is aligned on wanting better structures, clearer incentives, and a healthier position for RSR within the protocol. By improving transparency around governance power, formalising value accrual expectations, tightening operational processes, and giving RSR holders a clearer path into new DTFs from day one, we can strengthen the ecosystem meaningfully. The technology is strong and distribution is improving. The next step is ensuring that governance, incentives, and participation are set up in a way that keeps RSR and its community at the centre rather than at the edge. If we do that, we build a protocol that can scale while staying true to the principles that made people want to co-own it in the first place.

The Path Forward

The path forward is undoubtedly long and will include many twists and turns before we arrive at a protocol that the majority are happy with but if a focus is placed on reinstating RSR and its holders as a core pillar of the ecosystem significant gains can be made, creating a much more fertile, engaged and educated ecosystem that people will be proud to be a part of.

While there are no quick fixes to address the concerns that arise once my asterisks and caveats are taken as a whole I do believe there is some actions that can be taken relatively quickly (first half of the year) which will have a significant short-term positive impact on co-ownership, decentralisation, governance and community participation. These actions include;

Unification of siloed index DTF governance and staking rewards

- Bringing all the governance and staking rewards for all index DTF vlRSR positions benefits DTF curators as it reduced current frictions preventing them from tapping into Reserve’s pre-existing network of active participants and benefits the ecosystems active participants as they now have a central hub through which they can govern and receive revenue from index DTFs in a single click.

- It’s yet to be determined but JMGs suggestion for a veRSR model could work very well here with participants opting to max lock their RSR benefiting from the largest pro-rata share of voting power and index DTF revenue.

- In my mind it does not make sense for RSR staked on the DTFs built on the yield protocol to be included in this model given the additional slashing risk.

- Once an established and mature governance model has been built the model could begin to transcend index DTF governance and include protocol wide governance in its scope, e.g The burning of 30b RSR that is currently held in the teams treasury. However, if this route was chosen a weight would have to be determined for RSR staked on the Yield Protocol. Since the unlock duration is 2 weeks on the yield protocol the voting power of RSR on the yield protocol could be weighted equally with RSR under the new veRSR model employed in the index protocol.

Increased Transparency around ABC Labs / CC voting power

- ABC Labs and CC to increase transparency around their total stake on each DTF

- Stake RSR from a single address that is tagged with an ENS domain where possible (the Index Protocol doesn’t appear to support ENS Domains at present)

- Consider guidelines to prevent concentrating voting power between the core teams e.g a percentage of the total voting power for each DTF

- Quarterly self-reporting on voting power concentration including the amount of RSR staked on each DTF, which wallets contain the stake, the increase or decrease in stake over the quarter and the amount of RSR delegated. The forums could easily support this self-reporting.

Education and Incentive Programme to support Community Delegates

- While the above point suggests limiting both core teams’ stake to a percentage of total voting power, this does not limit the amount of RSR that can be staked on a DTF as it can be offloaded to other delegates.

- Currently to the best of my knowledge there are only three delegates in the ecosystem; myself, Sawyer and StakeDAO. However, three is inadequate to support decentralised governance. In order to support decentralised governance and to distribute the teams stake we need more delegates.

- I’ve recently read an after action report by StableLabs who conducted an education programme to increase the number of Scroll delegates and think something similar could be employed by Reserve, increasing the quality and community participation in governance through education. The graduates of this programme were rewarded a cash prize based on their final rank. In addition, 100,000 SCR was delegated through a Foundation multisig to high performing graduates, with up to 5,000 SCR in voting power per delegate. CC @Raphael_Anode.

- I think a similar model could be paired with ongoing incentives exclusively for programme graduates (maybe via a percentage of protocol fees) to support a diversified set of delegates, high quality contributions and decentralised governance.

Celebrate RSR Burns

- Burns which are kept on a tighter schedule, celebrated more with the community and data backed will help create a stronger community sentiment around the RSR token.

- This could be achieved with a stricter schedule where between two dates a month apart and an attestation report is posted on the forums a week later which could include comments on minting volume for each DTF, total fees, total RSR burn amount and links to the on-chain transactions.

- The goal of these monthly attestation reports is to not only celebrate the burns with Reserve’s existing community but is a place where burns can be independently verified by wider market participants and shows Reserve’s commitment to transparency.

New index DTF launch parties with RSR community

- Structured education and marketing to the RSR community at the launch of a new DTF will at the very least introduce new ecosystem participants to the RSR community and show their actions can lead to increased value accrual to the RSR token.

- The initiative could also further co-ownership as with a deep understanding of the index methodology and DTF metrics could convert a portion of the community to early DTF holders or governors.

Upgrade eUSD mandate, methodology and operational flows

- eUSD remains one of Reserve’s biggest RSR sinks with 2.5b RSR staked on the DTF. However, the current mandate, methodology and operation flows of the revenue share programme do not put RSR at the centre of the DTF and its current failings don’t allow for further on-boarding of fintech partners or for deeper community co-ownership. In my mind we need a second version, a complete rewrite of the Revenue Share Programme which focuses on fundamentals, transparency, optimal over-collateralisation levels, a path towards balanced value accrual to the RSR token and a mandate that aligns the basket with the wants and needs of eUSD’s fintech partners.

Summary

The issues outlined above form a pattern that affects how RSR holders participate in the ecosystem. Taken together, they show an environment where governance is concentrated, operational flows are unclear, and community members struggle to engage in a meaningful way. Without course correction, it becomes harder for existing participants to stay involved and even harder for new participants to see a path to co-ownership.

The most constructive way forward is to recentre RSR and its holders. Key steps include unifying index DTF governance and rewards, improving transparency around core team voting power, creating a structured delegate education and incentive programme, strengthening communication around burns, improving how new DTFs are introduced, and updating the eUSD mandate and revenue share model so it aligns fintech needs with staker and RSR value accrual. These changes alone would create immediate gains in decentralisation, clarity, and participation.

You may notice i’ve hardly commented on Metric Legibility and Protocol Dump Risk, this is because, in my mind, they are not the most urgent issues the ecosystem faces today and our governance flows are not yet decentralised enough for the community to make final decisions on them. These discussions should continue, but I’m happy for the team to lead on this until participation improves.