Hi @rspa_StableLab ,

eUSD began revenue-sharing with Fintechs (Ugly Cash, Sentz) 13 months ago, following conversations initiated 15 months back.

eUSD started sharing revenue with @Sawyer eUSD RToken Champion for governance and brand building 9 months ago.

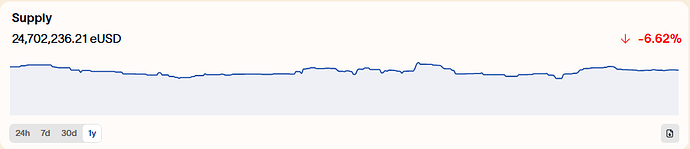

eUSD total TVL has decreased -6.62% during the last 12 months

The overall stablecoin market has grown 64% in the last 12 onths according to DefiLlama.

As reported at the top of this RFC, there have been 17 eUSD rev share changes in about 12 months, and tracking toward a standard cadence of 26/yr (bi weekly). The most material impact aside from the extra governance work, has been a decrease in yield shared with RSR stakers providing governance and overcollateralization.

In the most recent eUSD Quarterly report, less work is being done on awareness and brand (# of posts), and less impact is being had (impressions and engagement rate).

This is barely one post per day. Borrowing from a recent post from investor and brand builder Jon Wu.

“The internet is no longer deterministic. It’s algorithm-driven, and not even among your own followers. Your posts are constantly being shown to a panel of users. If they like it, the panel is expanded. If they don’t, you don’t get reach. That means putting out a high volume of posts isn’t noise / spam / “low signal.” Volume is necessary so the algorithm can pick up your winners and make them viral. You have to experiment with high volume, learn quickly, and double down on your winning formats. The cost of failure is ~0. The tree falls in the forest and no one sees it. But the cost of not experimenting is astronomical.”

Additionally the quarterly reports lack any substantive updates from rev share recipients Sentz and Ugly Cash. Are we in this together, or not? What’s working for them, what’s not, and where can the community contribute?

TLDR

- Heavy focus on revenue-share maintenance.

- But…eUSD TVL is shrinking while the stablecoin market expands.

- Little eUSD brand awareness growth; we’re absent from conversations with potential Fintech app partners.

- Excessive governance churn is creating fatigue, lowering safety through divided attention, meanwhile actually reducing eUSD overcollateralization.

- No feedback loop from Fintech partners on what’s working and what’s not.

What’s been repeatedly suggested, yet punted, is rebalancing eUSD’s governace and growth cost/benefit equation. The hypothesis: shift effort from governance churn toward brand-building and awareness, which would better serve the ecosystem.

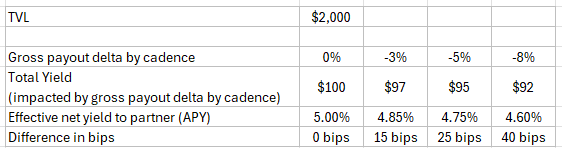

To move forward, we need an apples-to-apples comparison in a transparent spreadsheet with inspectable formulas, showing how 26x/year, 12x/year, and 4x/year revenue-share adjustments impact stakeholder payouts. The goal is to identify the threshold of diminishing returns and weigh the overall cost/benefit for the eUSD community.

“Gross payout delta by cadence.” If governance lift is reduced by more than 50%, is a 3% payout delta material? what about 5% or 8% delta? What is the delta target we are optimizing for and why?

“Effective net yield to partner” (APY). How does gross payout delta by cadence translate into effective net yield to partner (APY)?

Here is an illustration of the relationship:

But we can’t evaluate this in isolation. We also need to track the net yield actually paid to Sentz and Ugly Cash on their eUSD holdings. How does it stack up against alternatives like USDS or GHO? Quantitatively, what should eUSD’s yield premium be over sUSDS or competitors—50 bps, 100 bps, 200 bps?

Finally answering your post @rspa_StableLab.

IMO we should be voting AGAINST these revenue-share change proposals (or not putting them up at all) until a thorough impact analysis is completed (correct, transparent formulas, shared) and there is community consensus understanding, not punted. This situation perfectly illustrates eUSD’s current challenge: busywork theater, not enough impactful work.

We should complete this analysis and revisit the TLDR above to see what can be rebalanced for the overall good of the eUSD ecosystem. It won’t be perfect, but it can be much better.

I don’t mind putting up new proposals however I am hoping the current, compensated eUSD RToken Champion will take the lead on information and analysis disclosures and pulling the eUSD community together. Lot of opportunity here to compound the current eUSD RToken Champion configuration.

The comments here on the eUSD Q2 report further illustrate the opportunity.

We want eUSD to win. We want the RToken Champion to win. We want our fintech revenue-share partners to win. We want stRSR governors and overcollateral providers to win.